Report Overview

- Understand the latest market trends and future growth opportunities for the Wearable Electronics industry in globally with research from Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Global Wearable Electronics Market” by various segments at a global and regional level for the 2010-2027 period, with 2010-2020 as historical data, 2021 as a base year, 2022 as an estimated year and 2021-2028 as forecast period.

COVID-19 Impact on Wearable Electronics Market

- With the world having to adapt quickly to social distancing, the avoidance of touching surfaces where viruses can be transmitted, and the increased monitoring of people’s vital signs, it’s no wonder the wearable tech market, which offers solutions to all these challenges, is set to grow 25% by 2024.

- While workplaces have already been disrupted with Perspex screens, one-way systems, hand sanitizing stations and ‘bubbles’, the next big disruption in the workplace is going to be wearable devices. Statistics show that by connecting workers to one another and to resources, 50% of companies expect to see a boost in productivity. Where will this boost come from though and how can wearable’s help? We put together some of the key areas that wearable devices will impact in the future workplace and the challenges we need to overcome.

Description:

- The global market for Wearable Electronics estimated at US$35.7 Billion in the year 2022, is projected to reach a revised size of US$71.6 Billion by 2027, with a CAGR of 23.4% over the analysis period.

- The United States represents the largest regional market for Wearable Electronics, and is projected to reach US$28.9 Billion by 2027. China is expected to spearhead growth and emerge as the fastest growing regional market with a CAGR of 26.4% over the analysis period. all favoring growth.

- A large portion of wearable technology is in the nature of consumer electronics and healthcare and medicine. This region has several people exposed to the trend of adopting developing technologies, especially those people which fall within a range of good income.

- Wearable electronics is growing diverse and there can be several applications for this technology, ranging from health and medicine, communication and calling, listening to music. As the diversity and applications grow, so will the demand for the wearable technology.

The Wearable Electronics Report Includes:

- The report provides a deep dive details of the industry including definitions, classifications and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

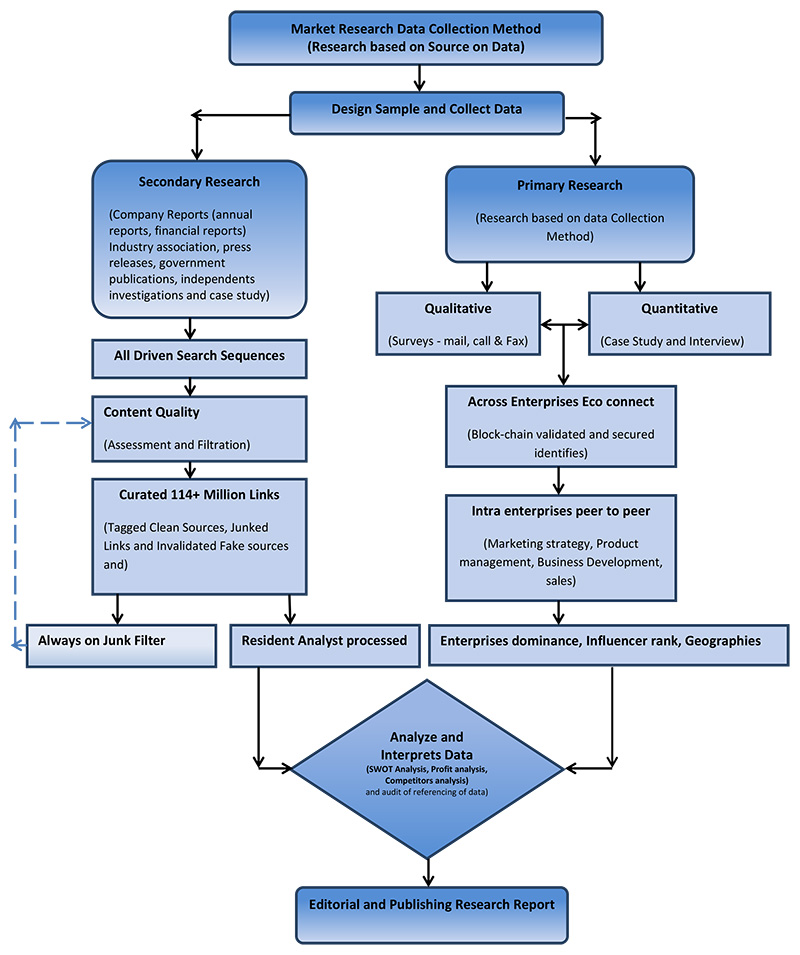

- Robust and transparent research methodology, conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- Market segments on the basis of type, application, end users, region and others.

- Discussion of the current state, setbacks, innovations, and the future needs of the market.

- Examination of the market by application and by product sizes; utility scale, medium scale and small scale.

- Country specific data and analysis for United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2022 | USD 35.7 billion |

| Revenue forecast in 2027 | USD 71.16 billion |

| Growth Rate | CAGR of 23.4% from 2021 to 2027 |

| Base year for estimation | 2021 |

| Historical data | 2015 – 2020 |

| Forecast period | 2022 – 2027 |

| Quantitative units | Revenue in USD million and CAGR from 2021 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Segments covered | Product, component, technology, application, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | Adidas AG; Amazon; Apple Inc.; AT&T, Inc.; Ava Women; By-Wire.Net; Cisco; Dexcom; Dynabook Americas, Inc.; Epson Corporation; Eurotech S.P.A; Fibretronic Ltd.; Fitbit, Inc.; Foxconn; Fujitsu; Garmin Ltd.; Glassup SRL; Google, Inc.; GOQii; Guangdong Bbk Electronics Co., Ltd; Huawei Technologies; IBM; Imprint Energy, Inc; Infineon Technologies Ag; Intel; Intellitix; Jakcom Technology Co.; Jawbone, Inc.; Lenovo; LG; Lifesense Group B.V.; Mclear Ltd.; Microsoft; Misfit, Inc.; Nike, Inc.; NVIDIA; Nymi; Olympus Corporation; O’Neill Wetsuits LIC.; Optinvent; Panasonic; Plastic Logic Ltd.; Qualcomm Technologies, Inc.; Recon Instruments, Inc.; Samsung; Seiko Epson; Shimmer Research, Inc.; Sony; Texas Instruments, Inc.; Token; Toshiba; Vancive Medical Technologies; Vuzix Corp.; Weartech s.l; WHOOP; Xiaomi Corporation; Zoog Technologies, Inc. and others. |

| Customization scope | Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

Wearable Electronics by Category

By Component:

- Sensor

- Power Supply Component

- Positioning & Networking Component

- Controller

- Display

- Memory

- Others (Interface)

By Product:

- Head Wear

- Helmet Mounted Display

- Smart Headset and Headband

- Eye Wear

- Smart Glasses/Eye Wear Display

- Contact Lenses

- Neck Wear

- Smart tie

- Others (Collars)

- Hand Wear

- Arm Wear

- Finger Wear

- Leg Wear

- Body Wear

- Smart Textile & Garment

- Others

By Technology:

- Computing Technology

- Display Technology

By Application:

- Consumer Electronics

- Infotainment Application

- Sports Application

- Fitness & Wellness Application

- Smart Garment

- Others

- Healthcare & Medical Application

- Clinical Application

- Non-clinical application

- Automotive & Transportation Application

- Military & Defense Application

- Others

Key Market Players

Adidas AG; Amazon; Apple Inc.; AT&T, Inc.; Ava Women; By-Wire.Net; Cisco; Dexcom; Dynabook Americas, Inc.; Epson Corporation; Eurotech S.P.A; Fibretronic Ltd.; Fitbit, Inc.; Foxconn; Fujitsu; Garmin Ltd.; Glassup SRL; Google, Inc.; GOQii; Guangdong Bbk Electronics Co., Ltd; Huawei Technologies; IBM; Imprint Energy, Inc; Infineon Technologies Ag; Intel; Intellitix; Jakcom Technology Co.; Jawbone, Inc.; Lenovo; LG; Lifesense Group B.V.; Mclear Ltd.; Microsoft; Misfit, Inc.; Nike, Inc.; NVIDIA; Nymi; Olympus Corporation; O’Neill Wetsuits LIC.; Optinvent; Panasonic; Plastic Logic Ltd.; Qualcomm Technologies, Inc.; Recon Instruments, Inc.; Samsung; Seiko Epson; Shimmer Research, Inc.; Sony; Texas Instruments, Inc.; Token; Toshiba; Vancive Medical Technologies; Vuzix Corp.; Weartech s.l; WHOOP; Xiaomi Corporation; Zoog Technologies, Inc. and others.

Top 5 Wearable Device Companies by Shipment Volume, Market Share, and Year-Over-Year Growth, Q1 2022 (shipments in millions)

| Company | 1Q22 Shipments |

1Q22 Market Share |

1Q21 Shipments |

1Q21 Market Share |

Year-Over-Year Growth |

| 1. Apple | 32.1 | 30.5% | 30.1 | 27.7% | 6.6% |

| 2. Samsung | 10.9 | 10.3% | 12.1 | 11.1% | -9.9% |

| 3. Xiaomi | 9.8 | 9.3% | 12.9 | 11.9% | -23.8% |

| 4. Huawei | 7.7 | 7.3% | 8.6 | 7.9% | -10.8% |

| 5. Imagine Marketing | 3.2 | 3.0% | 3.0 | 2.8% | 5.2% |

| Others | 41.7 | 39.6% | 41.9 | 38.6% | -0.5% |

| TOTAL | 105.3 | 100.0% | 108.6 | 100.0% | -3.0% |

Recent Developments

1Q22 Company Highlights

- Apple managed to grow 6.6% year over year during the quarter thanks to the performance of Apple Watches with the Apple Watch SE showing surprising resilience (over 2 million shipped) for a device that is more than one and half years old. Meanwhile, shipments of AirPods were flat during the quarter as the company faced more competition from low-cost products.

- Samsung ranked second although its unit shipments dropped nearly 10% compared to last year. Samsung has typically relied on strong smartphone sales to bundle wearables (especially hearables) in many markets. Like Apple, the company was not immune to competition from lower priced vendors and the sheer number of brands offering hearables. The additional competition combined with slowing smartphone sales led to a decline in shipments for hearables. Wristbands also declined along with the overall category. However, the latest Galaxy Watch 4 series continues to remain popular as the company’s watch shipments grew 32.7% during the quarter.

- Xiaomi’s decline was solely due to the weakness in the wristband category. That said, the company continues to make progress with watches and hearables and employs the same low cost, high value strategy.

- Huawei retained the fourth position even though overall shipments declined by 10.8% during the quarter. The company remains heavily focused on the local Chinese market although its presence in Europe has grown over time. That said, the Russian invasion of Ukraine has put a lot of downward pressure on the European market so Huawei’s sales into the region could be negatively impacted in the next few quarters.

- Imagine Marketing once again held its position within the global top 5 due to its large presence in India although they may be experiencing early signs of saturation as growth within hearables declined 3.8% during the quarter. As a result, the company has been growing its presence in the watch category even though overall shipments remain well below 1 million units.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2021 base year report.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

This report answers

- What is the market size of Wearable Electronics Globally and in your country?

- Which are the leading brands?

- How are products distributed?

- How is the rise of e-commerce changing the retail landscape?

- How has COVID-19 and accordant macroeconomic and retail disruption impacted consumer demand?

- How are considerations such as urban development and the rise in single-person households driving sales growth?

- Where is technology taking the market? Which products are pioneering growth? Which face obsolescence?

- Where is future growth expected to be most dynamic?