Report Overview

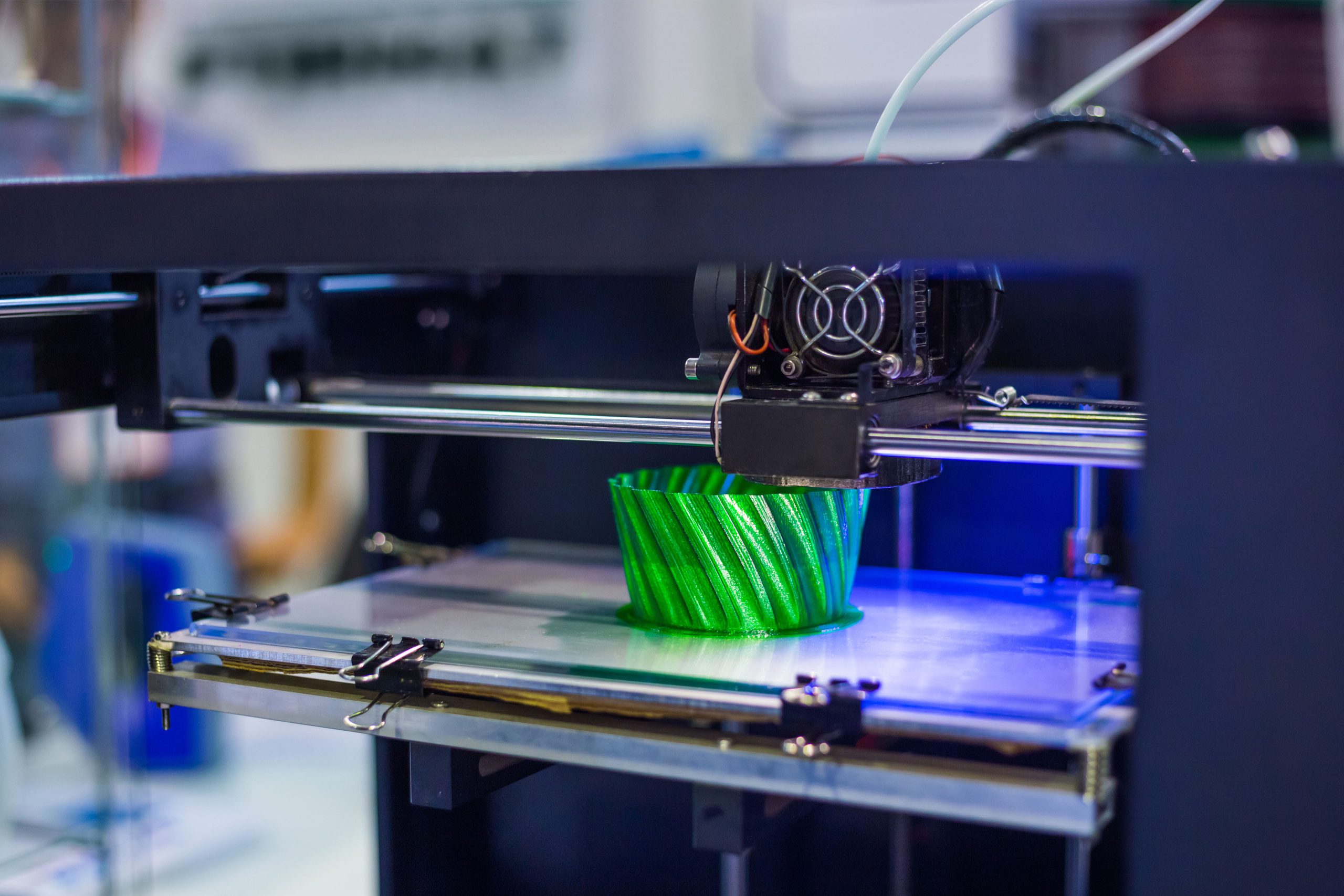

- Understand the latest market trends and future growth opportunities for the 3D Printing industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “3D Printing Market” by various segments at a global and regional level for the 2010-2027 period, with 2010-2021 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2028 as forecast period.

Description:

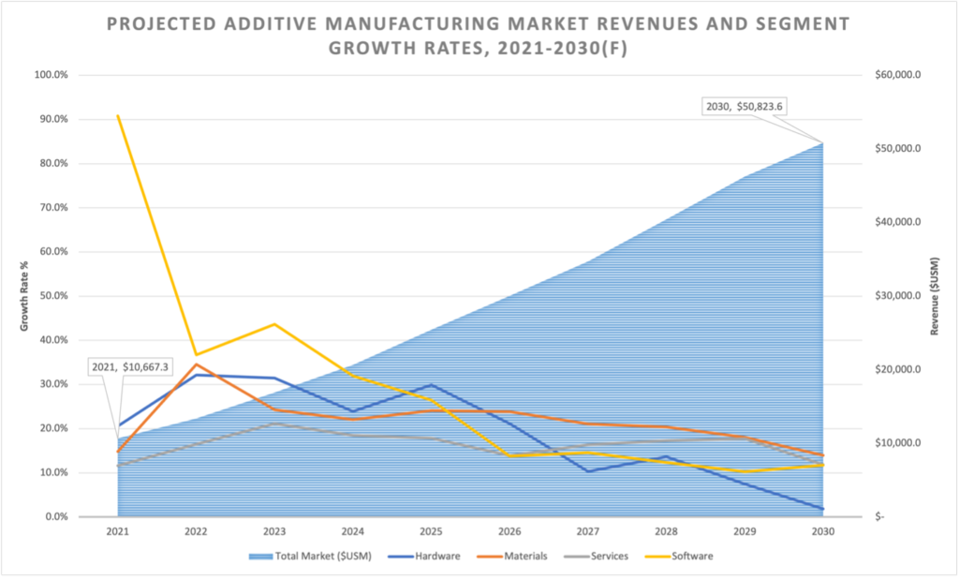

- In the post COVID-19 business landscape, the global market for 3D Printing estimated at US$20.8 Billion in the year 2022, is projected to reach a revised size of US$45.8 Billion by 2028, growing at a CAGR of 18.5% over the period 2022-2028.

- Printers, one of the segments analyzed in the report, is projected to record a 14.6% CAGR and reach US$14.5 Billion by the end of the analysis period. After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the Services segment is readjusted to a revised 18.9% CAGR for the next 7-year period.

- The 3D Printers market in the U.S. is estimated at US$5 Billion in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of US$10.1 Billion by the year 2028 trailing a CAGR of 22.5% over the analysis period 2023 to 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 13.7% and 16.1% respectively over the 2020-2028 period. Within Europe, Germany is forecast to grow at approximately 14.9% CAGR.

Covid Impact:

- Other than the COVID-related dip during 2020, the 3DP/AM market continues to grow steadily, having topped a $5B quarterly base in Q4 2021. In times of global market uncertainty, additive manufacturing represents a rather insulated pocket in terms of market activity.

- Supply chain disruptions have continued to impact revenue performance across industries and markets, in turn creating demand for additive manufacturing. Partially to this end, the Services represents the largest portion of the whole 3DP/AM market. Materials and Hardware are similar in size at the moment, and Software is the smallest, but fast-growing segment.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2027, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The 3D Printing Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

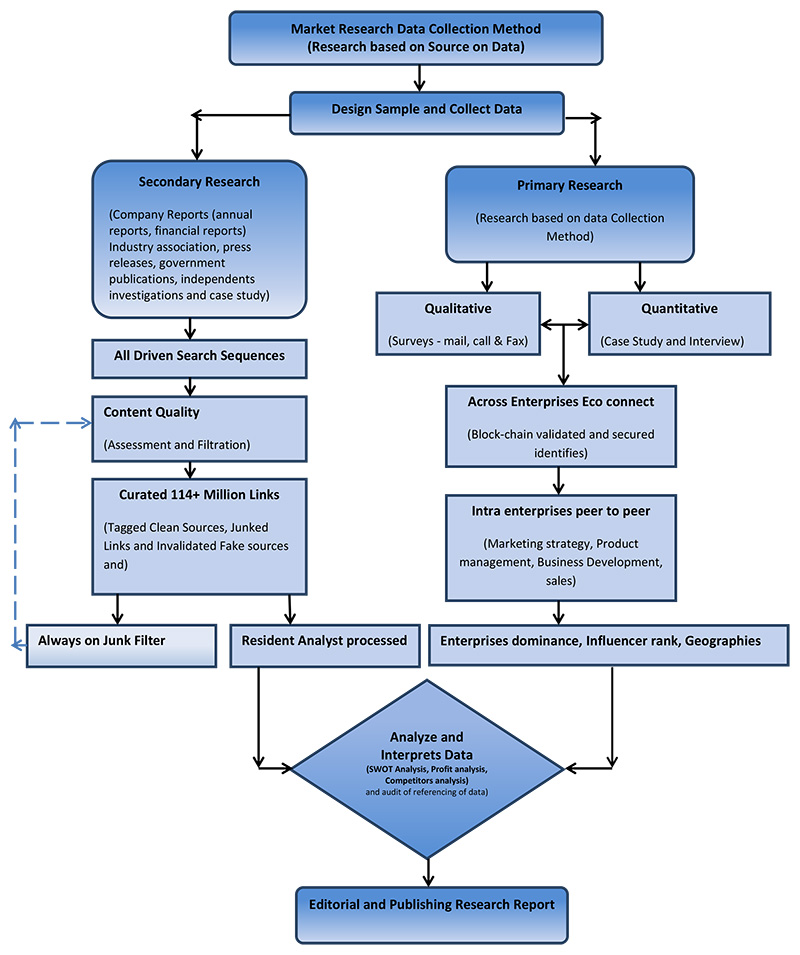

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2021 | USD 20.8 Billion |

| Revenue forecast in 2027 | USD 45.8 Billion |

| Growth Rate | CAGR of 18.5% from 2022 to 2028 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2021 |

| Forecast period | 2022 – 2028 |

| Quantitative units | Revenue in USD million and CAGR from 2021 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews. Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Product, Type, Component, Technology, Application, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | 3D Hubs; 3D Systems; 3D Universal; Additive Industries; AddUp Solutions; Arcam Group; Arconic; Arkema; Autodesk Inc.; BASF; Beam-IT; BigRep; Canon Inc.; Carbon 3D; Carpenter Technology Corporation; Cincinnati Inc.; Covestro; CRP Group; Desktop Metal; DMG Mori; Dutch Filaments B.V.; DWS; EnvisionTec, Inc.; EOS GmbH; Evonik; ExOne GmbH; Farinia; Farsoon; Fast Radius; FATHOM; FIT AG; Forecast3D; Formlab; General Electric Company (GE Additive); GKN Additive; Graphene 3D Lab Inc.; H.C. Starck; Heraeus; Hoganas; HP Inc; i3D MfG; Imagin Plastics Ltd.; Imperial Machine & Tool; Jabil; Leapfrog; Linde; Local Motors; Made In Space; Markforged; Materialise NV; My MiniFactory; Oerlikon; Optomec; Philips; Praxair Surface Technologies; Prodways; Proto Labs; Push Plastic; Rapidshape; Renishaw; Royal DSM N.V.; Sandvik; Shape ways; Siemens; Sintavia; Sisma SPA; SLM Solutions; Solvay; Star Rapid; Stratasys Ltd; Trumpf; Ultimaker; United Coatings Group; Velo3D; Voestalpine; Voxeljet AG; White Clouds; Wipro 3D; Xaar; Xerox; Xilloc; Zortrax and others |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

By Material

- Polymer

- Metal

- Ceramic

- Composites

- Construction

By Component

- Hardware

- Software

- Services

By Printer Type

- Desktop 3D Printer

- Industrial 3D Printer

By Technology

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Polyjet Printing

- Inkjet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing

- Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Vertical Outlook

- Industrial 3D Printing

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Others

- Desktop 3D Printing

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

Companies Covered in Report:

| 3D Hubs | Formlab | Philips |

| 3D Systems | Fraunhofer IKTS | Photocentric |

| 3D Universal | Gamma Alloys | Praxair Surface Technologies |

| Additive Industries | Gefertec | Prodways |

| AddUp Solutions | General Electric Company (GE Additive) | Proto Labs |

| AdvancD materials | GKN Additive | Push Plastic |

| Arcam Group | Glassomer | Rapidia |

| Arconic | Graphene 3D Lab Inc. | Rapidshape |

| Arevo | H.C. Starck | Renishaw |

| Arkema | Headmade Materials | Roboze |

| Arris Composites | Heraeus | Royal DSM N.V. |

| Autodesk Inc. | Hoganas | SAFINA |

| AzulD | HP Inc | Sandvik |

| BASF | i3D MfG | Schunk Carbon Technology |

| BCND Technologies | Imagin Plastics Ltd. | Sciaky |

| BeAM Machines | Imperial Machine & Tool | SGL Carbon |

| Beam-IT | Inkbit | Shape ways |

| BigRep | Jabil | Siemens |

| Canon Inc. | JuggerBotD | Sintavia |

| Carbon 3D | Kumovis | Sisma SPA |

| Carpenter Technology Corporation | Leapfrog | SKFine |

| Chiron | Linde | SLM Solutions |

| Cincinnati Inc. | Lithoz | Solvay |

| Continuous Composites | Local Motors | SPEED |

| Cookson Precious Metals | Lubrizol | Star Rapid |

| Covestro | Made In Space | Stratasys Ltd |

| CRP Group | Mantle | TethonD |

| D Ceram | Markforged | Titomic |

| D Systems | Massivit D | Tritone Technologies |

| Desktop Metal | Materialise NV | Trumpf |

| DMG Mori | Mechnano | Ultimaker |

| Dutch Filaments B.V. | Meltio | Uniformity Labs |

| Electroimpact | MetallumD | United Coatings Group |

| Elementum D | Metalysis | UpNano |

| EnvisionTec, Inc. | Mitsubishi Chemical | Velo3D |

| EOS GmbH | Moi Composites | Voestalpine |

| Equispheres | Molecular Rebar | Voxeljet AG |

| Evolve Additive Solutions | MXD | WAAMD |

| Evonik | My MiniFactory | White Clouds |

| Exaddon | Nano Dimension | Wipro 3D |

| ExOne GmbH | NanoAL | Xaar |

| Exponential | Nanoe | Xerox |

| Farinia | NexaD | Xi’an Bright Laser Technology |

| Farsoon | nScrypt | Xilloc |

| Fast Radius | Oerlikon | XJet |

| FATHOM | One Click Metal | Xolo |

| FIT AG | Optomec | ZDLAB |

| Forecast3D | Orbital Composites | Zortrax |

Recent Developments

- October 2022: AML3D Australian metal 3D printing expanded its partnership with Boing aircraft manufacturer. Boeing tasked AML3D earlier this year with 3D printing aluminum prototype airplane components as part of an intensive testing procedure in which they were tested against the requirements of AS9100D quality assurance for ‘fly’ parts. Building on this contract, it has now been decided to broaden the scope of the project to include the provision of additional 3D-printed components, increasing the agreement’s value by 150%.

- October 2022: PostProcess Technologies and EOS have launched a distribution relationship to provide EOS clients with a fully automated and sustainable depowering solution. According to PostProcess, the Variable Acoustic Displacement (VAD) technology solution will complement the EOS printer product line and automate gross depowering for 3D printed parts. The partnership makes it easier for consumers to obtain post-printing solutions, allowing for complete process digitization.

- February 2022 – Imaginarium, one of the global leaders in 3D Printing solutions and advanced manufacturing technology, announced the launch of its desktop and industrial 3D printer range in partnership with 3D printing giant Ultimaker.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2022 base year report.

- Free Updated edition of 2023 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions that are answered in this report

- What are the current and emerging printer technology types within different material specialties?

- How do metrics such as price, build speed, build volume and precision vary by printer type and material class?

- What are the strengths and weaknesses of different 3D printing technologies?

- Which printers support different material classes?

- What is the current installed base of 3D printers?

- Who are the main players?

- What are the market shares of those active in the market?

- What are the current and emerging 3D printing materials in 2023?

- What are the market shares of each material class?

- What are the key drivers and restraints of market growth?

- What are the main application areas of additive manufacturing?

- How does 3D printing hardware and materials relate to post-processing, software, scanners, and services?

- How will sales of different printer types evolve from 2022 to 2028?

- What is the projected demand by mass and annual revenue growth for materials from 2022 to 2028?

- How has COVID-19 positively or negatively impacted the 3D printing industry?