Report Overview

- Understand the latest market trends and future growth opportunities for the Electric Vehicles (EVs) industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Electric Vehicles (EVs) Market” by various segments at a global and regional level for the 2010-2030 period, with 2010-2021 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2030 as forecast period.

Description:

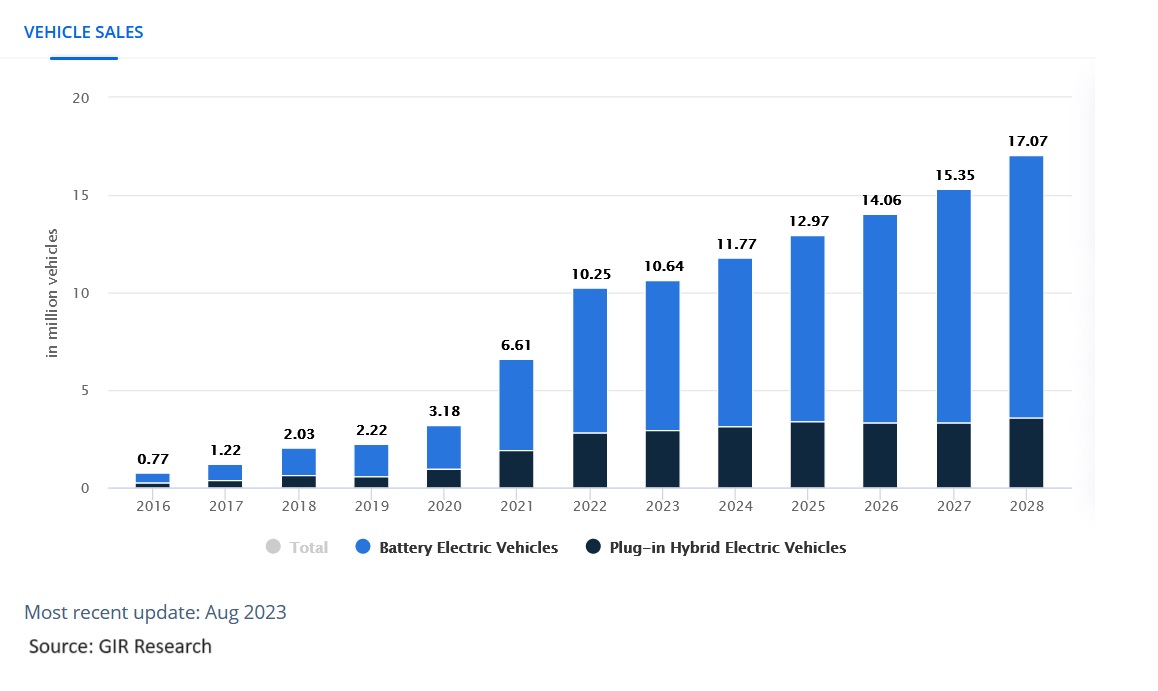

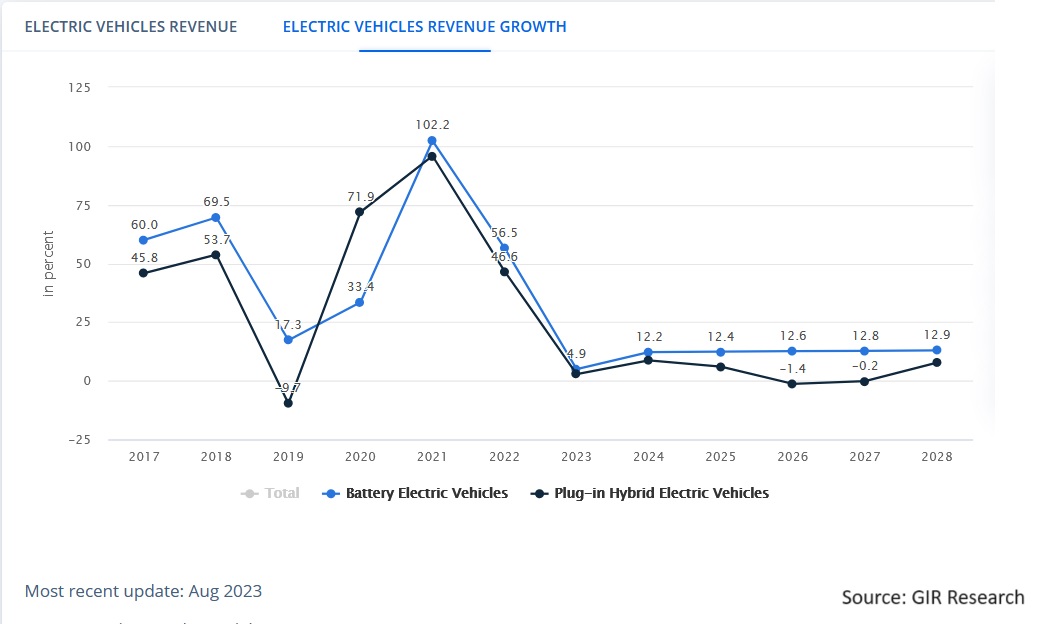

- In the changed post COVID-19 business landscape, the global market for Electric Vehicles (EVs) estimated at 9.5 Million Units in the year 2022, is projected to reach a revised size of 80.7 Million Units by 2030, growing at a CAGR of 30.7% over the period 2022-2030.

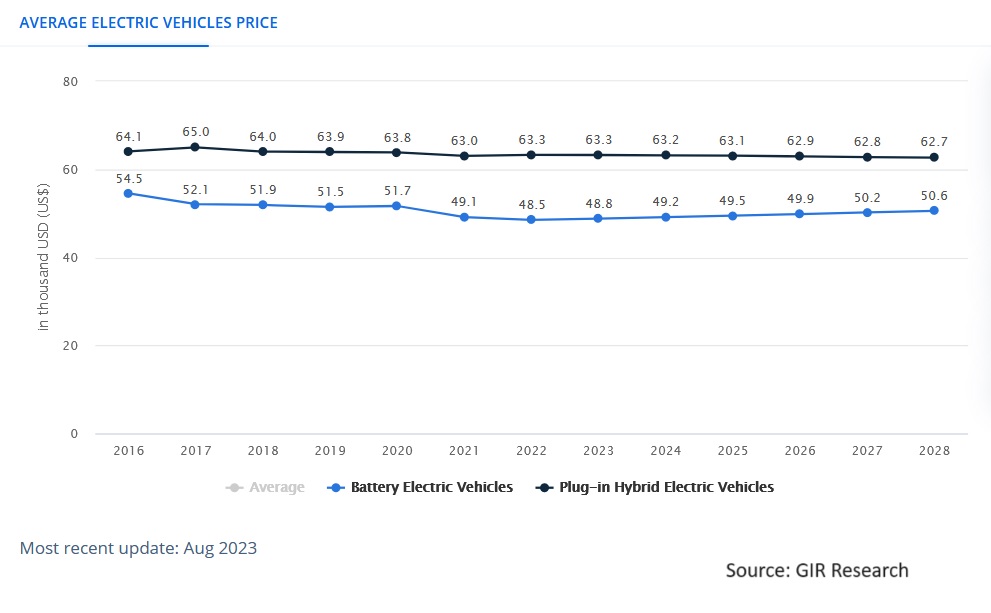

- Battery Electric Vehicles (BEVs), one of the segments analyzed in the report, is projected to record 34.8% CAGR and reach 74.4 Million Units by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Plugin Hybrid Electric Vehicles (phevs) segment is readjusted to a revised 11.6% CAGR for the next 8-year period.

- The Electric Vehicles (EVs) market in the U.S. is estimated at 882.3 Thousand Units in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of 36.5 Million Units by the year 2030 trailing a CAGR of 28.6% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 20.7% and 27.3% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 29.1% CAGR.

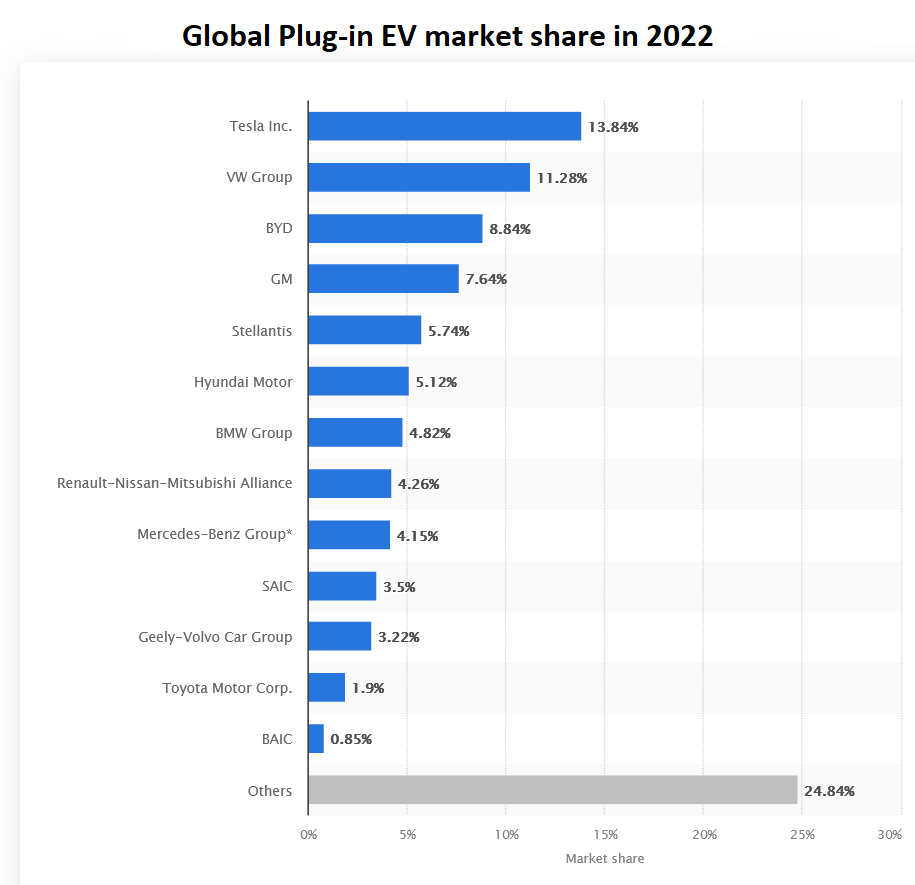

- Tesla was ranked as the best-selling electric vehicle manufacturer worldwide after selling close to 936,200 units in 2021. Tesla’s sales volume translates into a market share of just under 14 percent. Volkswagen Group and BYD were among the runners-up.

- Electric vehicle (EV) market in the United States is expected to flourish with government incentives driving EV ownership.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2030, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

- xEV registration/sales data: Monthly registrations on all BEV, PHEV, FCEV and HEV by country and model.

- Future plug-in (BEV & PHEV) vehicle roll-out calendar 2020-2027.

- Vehicle Specification database on all selling plug-ins (BEV & PHEV).

- Charging Infrastructure database by Country and Connector Type.

- Battery Shipment Tracker by Chemistry, Battery Maker & to which OEM, in MWh.

- BEV, PHEV & HEV Share tracker by country, Inventory & Order back-log,

- BEV & PHEV Buses & CV Registrations.

- OEM & Model & Battery Demand Forecast 2030, BEV & PHEV, with regional sales.

The Report Includes:

- In-depth exploration of the industry, encompassing definitions, classifications, and the industry’s interconnected structure.

- Examination of pivotal supply-side and demand trends.

- Detailed breakdown of both international and local products.

- Insight into historical volume and value dimensions, along with market shares of companies and brands.

- Five-year predictions regarding market trends and growth.

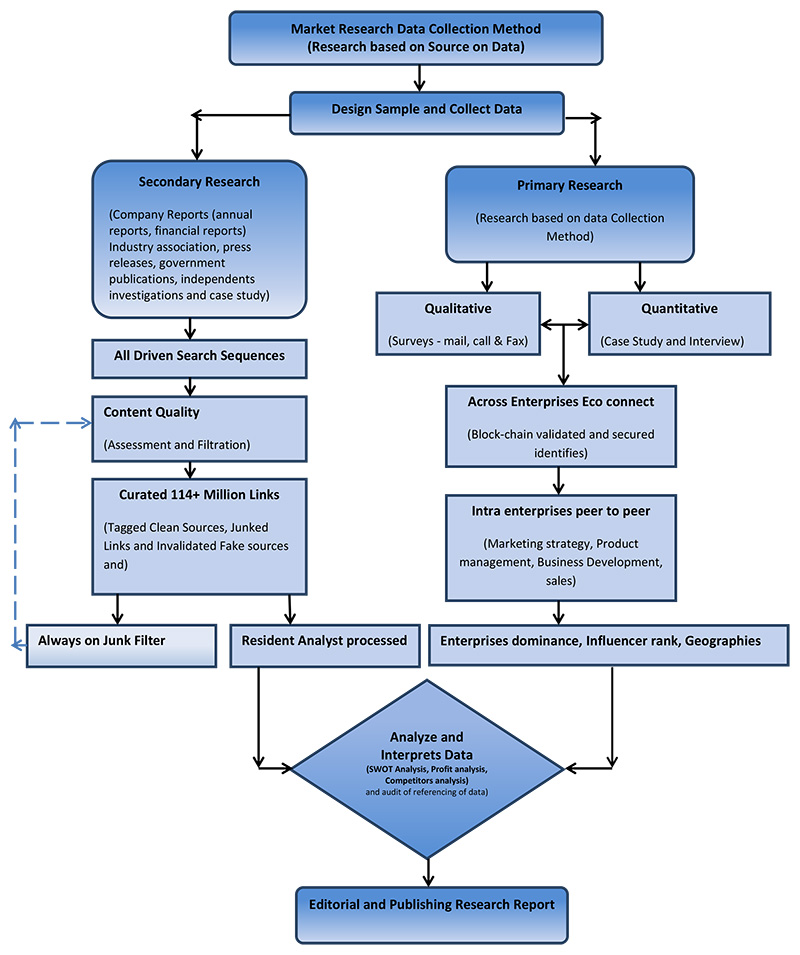

- A robust and transparent research methodology conducted within the country.

- A blend of qualitative and quantitative analysis, grounded in segmentation that considers economic and non-economic aspects.

- Provision of market value data (in USD Billion) for every segment and sub-segment.

- Geographical, regional, national, and state-wise analysis.

- A succinct overview of the commercial potential inherent in products, technologies, and applications.

- Company profiles of key market players operating within the product category.

- Descriptions of attributes and manufacturing processes.

- Segmentation based on type, application, end-users, regions, and other factors.

- Discussion about the current state, challenges, innovations, and future requirements of the market.

- Examination of the market based on application and product sizes: utility-scale, medium scale, and small-scale.

- Country-specific insights and analyses for major countries and regions.

- Coverage of historical context, pivotal industrial developments, and regulatory frameworks.

- Analysis of competitive movements, including agreements, expansions, new products, and mergers & acquisitions.

- Exploration of opportunities for stakeholders and a depiction of the competitive landscape among market leaders.

- Specialized coverage of significant global events, such as the Russia-Ukraine war, global inflation, China’s “zero-Covid” policy shift, supply chain disruptions, trade tensions, and the risk of recession.

- Evaluation of global competitiveness and market shares among key competitors.

- Presence assessment across various geographical markets: Strong, Active, Niche, Trivial.

- Online, interactive, peer-to-peer collaborative updates.

- Access to digital archives and the Market Research Platform.

- Complimentary updates for a two-year period.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size in 2022 | 9.5 Million Units |

| Market size forecast in 2030 | 80.7 Million Units |

| Growth Rate | CAGR of 30.7% from 2022 to 2030 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2022 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Components, Vehicle Type, Vehicle Class, Top Speed, Vehicle Drive Type, EV Charging Point Type, Vehicle Connectivity, End Use, Propulsion and Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, China, Japan, Germany, India, United Kingdom, France, Brazil, Italy, Canada, South Korea, Australia, Russia, Spain, Mexico, Indonesia, Netherlands, Switzerland, Saudi Arabia, Turkey, Taiwan, Poland, Sweden, Belgium, Thailand, Austria, Nigeria, Argentina, United Arab Emirates, Iran, Norway, Israel, Ireland, Malaysia, Denmark, Singapore, Philippines, Pakistan, Finland, Chile, Vietnam, Greece, Czech Republic, Romania, Portugal, Peru, New Zealand, Hungary, Iraq, Bangladesh, Qatar, Kuwait, Ukraine, Egypt, Kazakhstan, Colombia, Angola, Algeria, Morocco, Slovakia, Oman, Puerto Rico, Ethiopia, Sudan, Kenya, Ghana, Dominican Republic, Myanmar, Tanzania, Ecuador, Belarus, Guatemala, Lithuania, Latvia, Sri Lanka, Nepal, Lebanon, Slovenia, Bahrain, Libya and others |

| Key companies profiled | AIXAM MEGA SAS; ALIENO; Alkane Truck Company; American Honda Motor Co., Inc.; Anhui Jianghuai Automobile Co., Ltd.; Aptera Motors Corporation; Arcimoto, Inc.; Audi AG; Balqon Corporation; Blue Bird Corporation; BMW AG; Bollinger Motors; Brilliance Auto Group; BYD Co., Ltd.; Cadillac; CAF; Canadian Electric Vehicles; Beijing Automotive Industry Corp. (BAIC); Chang`an Automobile (Group) Co., Ltd.; Changan Automobile; Chery Automobile Co., Ltd.; Chevrolet; Construcciones y Auxiliar de Ferrocarriles, S.A.; Dongfeng Motor Corporation; ElectraMeccanica Vehicles Corp.; Faraday Future; FAW Group; Fisker Inc.; Ford Motor Company; Geely (including Volvo Cars); General Motors; Great Wall Motors; Groupe PSA; Honda Motor Co., Ltd.; Hyundai Motor Company; Jaguar Land Rover; Karma Automotive; Kia Corporation; Li Auto Inc.; Lordstown Motors Corp.; Lucid Motors, Inc.; Mahindra & Mahindra; Mazda Motor Corporation; Mercedes-Benz (Daimler AG); Mitsubishi Motors Corporation; Nikola Corporation; NIO Inc.; Nissan Motor Corporation; Porsche AG; Proton Holdings Berhad; Renault Group; Rivian Automotive, Inc.; SAIC Motor Corporation; SsangYong Motor Company; Stellantis (formerly Fiat Chrysler Automobiles); Subaru Corporation; Suzuki Motor Corporation; Tata Motors; Tesla, Inc.; Tofas Turk Otomobil Fabrikasi; Toyota; VinFast; Volkswagen Group; Volvo Cars; Workhorse Group Inc.; Xpeng Motors; Zotye Auto and others |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

Report Segmented by:

Electric Vehicles (EVs) Market Based on Components:

- Battery Cells & Packs

- On-Board Charge

- Motor

- Reducer

- Fuel Stack

- Power Control Unit

- Battery Management System

- Fuel Processor

- Power Conditioner

- Air Compressor

- Humidifier

Electric Vehicles (EVs) Market Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Electric Vehicles (EVs) Market Based on Vehicle Class:

- Low-priced

- Mid-priced

- Luxury

Electric Vehicles (EVs) Market Based on Top Speed:

- <125 MPH

- >125 MPH

Electric Vehicles (EVs) Market Based on Vehicle Drive Type:

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

Electric Vehicles (EVs) Market Based on EV Charging Point Type:

- Normal Charging

- Super Charging

Electric Vehicles (EVs) Market Based on Vehicle Connectivity:

- V2B or V2H

- V2G

- V2V

- V2X

Electric Vehicles (EVs) Market Based on Propulsion:

- BEV

- PHEV

- FCEV

Electric Vehicles (EVs) Market Based on End Use:

- Private

- Commercial Fleets

Electric Vehicles (EVs) Market Based on the region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Rest of the World

Companies Covered in Report:

| Acura Automobiles | Karma Automotive |

| Adaptive City Mobility (ACM) | Karsan Otomotiv Sanayii ve Tic. A.S. |

| Addax Motors NV | Kia Motors Corporation |

| Aiways Automobile Europe GmbH | Korea Electric Power Corporation (KEPCO) |

| AIXAM MEGA SAS | Korea Electrotechnology Research Institute (KERI) |

| ALIENO | Lexus India |

| Alkane Truck Company | Li Auto Inc. |

| Alke Srl | Lightning eMotors |

| Alpha Motor Corporation | Lincoln Motor Company |

| American Honda Motor Co., Inc. | Lion Electric Co. |

| Anhui Ankai Automobile Co. Ltd. | Lordstown Motors Corp. |

| Aptera Motors Corporation | Lotus Cars |

| Arcadia | Lucid Motors, Inc. |

| Arcimoto, Inc. | Mahindra & Mahindra Ltd. |

| Arrival Ltd. | Man Truck & Bus AG |

| Aspark Co., Ltd. | Mazda Motor Corporation |

| Atlis Motor Vehicles | Mercedes-Benz AG |

| Audi AG | Mitsubishi Motors Corporation |

| Automobili Pininfarina GmbH | Moke International Limited |

| AVEVAI | Mullen Technologies, Inc. |

| BAIC Motor Corporation | Myers EV |

| Balqon Corporation | National Electric Vehicle Sweden AB |

| Bavina Cars (India) Limited | NEXT Future Transportation, Inc. |

| Bayerische Motoren Werke AG (BMW GROUP) | Next.e.GO Mobile SE |

| Benteler International AG | NFI Group |

| Bentley Motors | Nikola Motor Company |

| Blue Bird Corporation | Ningbo Century EVA Motors Co., Ltd. |

| BMW AG | NIO Limited |

| Bollinger Motors | Nissan Motor Corporation |

| Boulder Electric Vehicle, Inc. | NMKV Co. Ltd. |

| BrightDrop | Olectra Greentech Limited |

| Buddy Electric AS | Olympian Motors |

| BYD Company Ltd. | Opel Automobile GmbH |

| Cadillac | Orange EV |

| CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. | Otokar Otomotiv ve Savunma Sanayi A.S. |

| Canadian Electric Vehicles | PACCAR Inc. |

| Canoo Inc. | Peugeot Motor Company PLC |

| CECOMP S.p.A. | Phoenix Motorcars, LLC |

| Cenntro | Pininfarina S.p.A. |

| Changan Automobile | Polestar |

| Chariot Motors AD | Porsche AG |

| Chery Automobile Co Ltd. | Power Vehicle Innovation |

| CHERY NEW ENERGY | Proterra Inc. |

| Chevrolet | Quantron AG |

| Chongqing Sokon Industrial Group Co., Ltd (DFSK) | Rac Electric Vehicle, Inc. |

| Citroen UK | Renault Group |

| CityFreighter Inc. | Rhema Motors, LLC |

| Clean Fuel Energy Enterprise Co., Ltd. | Rimac Automobili |

| Commuter Cars Corporation | Rivian Automotive, Inc. |

| CROYANCE AUTO | SAIC MAXUS Automotive Co., Ltd. |

| DAF Trucks NV | SAIC Motor |

| Dawes Cycles Ltd. | Scania AB |

| Daymak, Inc. | SEAT SA |

| DENZA | SERES, Inc. |

| Detroit Electric Holdings Ltd. | Sevic Systems SE |

| Devam Electric Vehicles Private Limited | Shandong Tangjun Ouling Automobile Manufacture Co., Ltd. |

| Dongfeng Yulon Motor Co., Ltd. | Shenzhen Greenwheel Electric Vehicle Group Co., Ltd. |

| Dr. Ing. HCF Porsche AG | Singulato Motors |

| Drako Motors, Inc. | SKODA AUTO AS |

| Dubuc Motors | Smith Electric Vehicles Corp. |

| Ebusco Bv | Softcar |

| ECOmove GmbH | Sono Motors |

| E-Force One AG | Speedways Electric |

| Elaphe Ltd. | Stellantis N.V. |

| ElectraMeccanica Vehicles Corp. | Stevens Vehicles Ltd. |

| Eli Electric Vehicles | Streetscooter Engineering GmbH |

| Elio Motors, Inc. | Subaru Corporation |

| ENOVATE Motors | Switch Mobility Ltd. |

| Envirotech Vehicles, Inc. | TÃkiye nin Otomobili Girisim Grubu A.AS |

| Etrio Automobiles Pvt Ltd | Tazzari EV |

| Evolio | TEMSA Skoda Sabancı Ulasım Aracları Anonim Sirketi. |

| Exagon Motors | Tesla, Inc. |

| Faction Technology, Inc. | Tevva Motors Ltd |

| Faraday Future | The Hyundai Motor Group |

| Fisker Inc. | Thunder Power Holdings |

| Fomm Corporation | Toyota Motor Corporation |

| Ford Motor Company | Traton |

| Foton Motor Inc. | Triton |

| fox e-mobility AG | Tropos Motors |

| FreeRider Corporation | Ukeycheyma |

| Furosystems (MA MICRO LTD.) | Universal Electric Vehicle Corporation (UEV) |

| General Motors Company | VDL Groep |

| Genesis Motor, LLC | VIA Motors, Inc. |

| Global Electric Motorcars (GEM) | VinFast Auto, LLC |

| GMC Hummer | Volkswagen Group |

| Gokube, Inc. | Volta Trucks Ltd. |

| Great Wall Motor Company Ltd. | Volvo Car Corporation |

| GreenPower Motor Company | VOYAH Motor |

| Guangzhou Automobile Group Co. Ltd. | Welectric |

| Guangzhou Langqing Electric Car Company Limited | WM Motor Technology Co., Ltd. |

| Henan Suda Electric Vehicle Technology Co., Ltd. | Workhorse Group Inc. |

| Hino Motors Ltd. | Wuxi Yiwei Automobile Sales Co., Ltd. |

| Hitech Electric | Xiamen King Long United Automotive Industry Co., Ltd. |

| Honda Motor Co., Ltd. | Xiaopeng Motors |

| Hozon New Energy Automobile Co. Ltd. | Xos Trucks |

| Hubei Qixing Vehicle Body Co., Ltd. | XPENG European Holding B.V |

| Human Horizons (HiPhi) | Xpeng Motors |

| Hyliion | Yinlong Energy China Ltd. |

| Hyundai Motor Company | Zero Emission Vehicles Limited |

| Hyzon Motors Inc. | Zero Labs Automotive |

| Indra Renewable Technologies Ltd. | Zhejiang Geely Holding Group Co. Ltd. |

| Industrial Technology Research Institute (ITRI) | Zhejiang Leapmotor Technology Co.,Ltd (Leap Motor) |

| Innova EV (Dash EV) | Zhejiang Luqi Intelligent Technology Company Limited |

| Irizar | Zhejiang Today Sunshine New Energy Vehicle Industry Co., Ltd. |

| Italcar Industrial S.r.l. | Zhengzhou Yutong Bus Co., Ltd. |

| Iveco SpA | ZhiDou Electric Vehicles |

| Jaguar Land Rover | Zhongtong Bus Holding Co., Ltd. |

| JBM Group | Zoox |

| Jiangsu Min an Electric Vehicle Co., Ltd. | Zotye Automobile Co., Ltd. |

| JLC Group Ltd. | Others |

| Kandi America |

Explore in-depth market insights from the following data in our ‘Electric Vehicles Market’ report including:

- Electric vehicles market overview at the global and country level covering eleven key countries in depth.

- Key growth drivers and challenges at the global level.

- Market size by volume and value – globally and country-wise.

- Electric vehicle and charging infrastructure policy analysis in each of the key countries.

- Electric vehicle market segmentation globally and in each of the key countries.

- Key players and market share in each of the key countries.

How is our ‘EV Market’ report different from other reports in the market?

- Facilitate decision-making by providing trend analysis in the electric vehicles market.

- Develop business strategies by understanding the drivers and challenges of the market.

- Position yourself to gain the maximum advantage of the industry’s growth potential.

- Maximize potential in the growth of the electric vehicles market.

- Identify key partners, geographies, and business-development avenues.

- Respond to business structure, strategy, and prospects.

We recommend this valuable source of information to anyone involved in:

- Electric Vehicle Manufacturers/ EV Assembling Vendors

- Battery Manufacturers

- Automotive Companies and Start-ups

- Semiconductors

- Commodity Miners & Traders

- EV Charging Infrastructure Providers

- Auto Component Providers

- Consulting Companies

- Legal & Financial Advisors

- Private Equity & VC Firms

- Regulatory bodies

Market Overview

- The report combines historical analysis with projections to 2030, covering areas such as EV and charging infrastructure deployment, energy use, CO2 emissions, battery demand, and policy developments.

- China, Europe, and the United States are the leading EV markets.

- Notable progress in advancing electric cars has been made in Norway, China, the European Union, and the United States.

EV Sales

- Electric car sales achieved a 14% sales share in 2022, exceeding 10 million units, despite challenges like supply chain disruptions.

- The growth in electric car sales has been exponential, jumping from around 1 million in 2017 to over 10 million in 2022.

- In the Net Zero Scenario, electric car sales are projected to reach around 65% of total car sales by 2030, requiring an average annual growth rate of around 25% from 2023 to 2030.

Battery Manufacturing

- In 2022, global lithium-ion automotive battery manufacturing capacity was approximately 1.5 TWh.

- Announced battery production capacity by private companies for EVs to be in place by 2030 amounts to 6.9 TWh.

- In the Net Zero Scenario, battery demand for EVs is expected to reach around 5.5 TWh in 2030 and announced capacity in 2030 is expected to cover these requirements.

Policy Developments

- Governments worldwide are adopting policies to support EV supply chains, vehicle and battery manufacturing, and critical mineral supply chains.

- Examples include California’s ZEV mandates, the European Union’s CO2 standards, and the United States’ proposed GHG emissions standards.

- Policies aim to encourage industry investment, domestic manufacturing, and reduced emissions.

Voluntary Targets

- Automakers are increasingly setting voluntary EV targets, aiming for a higher share of EV sales in their portfolios.

- Examples include Mitsubishi’s goal of 100% EV sales by 2035, Jaguar’s plan to go all-electric by 2025, and SAIC-GM-Wuling’s target of annual sales of 1 million NEVs by 2023.

Market Dynamics

- Reducing prices of EV batteries are making EVs more cost-effective and competitive with traditional ICE vehicles.

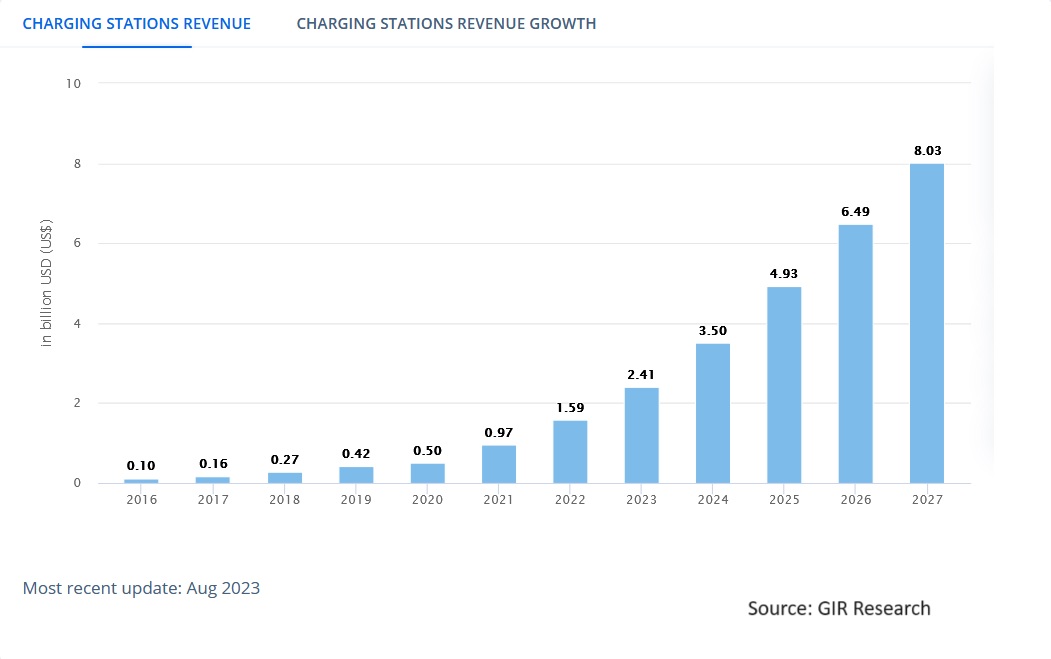

- High initial investments in EV fast charging infrastructure remain a challenge, but technological advancements are expected to reduce costs.

- Rising demand for electric vehicles in automotive and transportation sectors is driving investments and adoption.

- The high cost of electric vehicles compared to ICE vehicles remains a challenge, but battery price reductions and lower manufacturing costs are expected to address this issue.

Market Ecosystem

- FCEVs (Fuel Cell Electric Vehicles) are expected to be the fastest-growing segment, with advantages in emissions and refueling time.

- The mid-priced EV segment is anticipated to be the largest market, offering reasonably priced electric vehicles.

- Asia Pacific is poised to be the largest and fastest-growing market for EVs, with governments promoting EV adoption and investments in manufacturing.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2022 base year report.

- Free Updated edition of 2023 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or selected Chapters from the report.

Key questions that are answered in this report

Market Overview

- What is the current size of the EV market by volume?

- How has the EV market grown in recent years?

- What is the projected growth rate of the EV market by 2030?

- What factors are driving the growth of the EV market?

- What are the key challenges facing the EV market?

- How is the adoption of electric vehicles expected to impact traditional automakers?

Market Trends and Outlook

- What are the key trends in the EV market for 2023?

- How is consumer sentiment towards EVs changing?

- What role do government incentives play in the EV market’s growth?

- What is the outlook for electric vehicle charging infrastructure?

- How will the EV market be affected by global supply chain challenges?

- What is the outlook for the used EV market?

- How are EV manufacturers addressing range anxiety?

Electric Vehicle Types

- What types of electric vehicles are available in the market?

- How do electric cars compare to electric SUVs in terms of popularity?

- What is the market share of electric trucks and vans?

- Are electric motorcycles gaining traction in the market?

- What is the outlook for electric buses and public transportation?

Winning Companies and Models

- Who are the winners in the EV market in terms of market share?

- Which electric vehicle models are best-sellers in 2023?

- How do Tesla’s sales compare to other EV manufacturers?

- What are the competitive advantages of established automakers in the EV space?

- Are startups making significant inroads in the EV market?

Charging Infrastructure

- How extensive is the electric vehicle charging network globally?

- What technologies are driving improvements in EV charging speed and convenience?

- How is wireless charging technology evolving for EVs?

- What is the role of fast-charging stations in promoting EV adoption?

- How do charging solutions for urban and rural areas differ?

Regional Markets

- Which region will have the fastest-growing market for EVs?

- What are the key differences in EV adoption between North America, Europe, and Asia?

- How do government policies and regulations differ by region?

- What are the unique challenges faced by emerging markets in adopting EVs?

Technological Advancements

- What are the key technologies affecting the EV market?

- How are advancements in battery technology impacting EV range and affordability?

- What role do autonomous driving features play in the EV market?

- How is vehicle-to-grid (V2G) technology being integrated into EVs?

- What innovations are being made in electric vehicle manufacturing processes?

Sustainability and Environmental Impact

- How do EVs contribute to reducing greenhouse gas emissions?

- What is the life cycle environmental impact of EVs compared to internal combustion engine vehicles?

- How are automakers addressing the sustainability of EV batteries?

- What are the prospects for recycling and repurposing EV batteries?

Market Challenges

- How are EV manufacturers addressing concerns about rare earth metal sourcing?

- What are the challenges of scaling up EV production to meet growing demand?

- How is the EV market affected by fluctuating raw material prices?

- What cybersecurity risks are associated with connected EVs?

Consumer Considerations

- What are the financial incentives for consumers to switch to electric vehicles?

- How do electric vehicle maintenance costs compare to traditional cars?

- What is the average payback period for the higher upfront cost of EVs?

- How are automakers addressing concerns about EV resale value?

- What are the prospects for EVs in the luxury car segment?