Report Overview

- Understand the latest market trends and future growth opportunities for the Ceramic Tiles industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Ceramic Tiles Market” by various segments at a global and regional level for the 2010-2030 period, with 2010-2021 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2030 as forecast period.

Description:

- The global market for Ceramic Tiles estimated at US$383.1 Billion in the year 2022, is projected to reach a revised size of US$771.2 Billion by 2030, growing at a CAGR of 9.1% over the period 2022-2030.

- Porcelain, one of the segments analyzed in the report, is projected to record 10.4% CAGR and reach US$417.8 Billion by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Glazed segment is readjusted to a revised 7.5% CAGR for the next 8-year period.

- The Ceramic Tiles market in the U.S. is estimated at US$104.4 Billion in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of US$179 Billion by the year 2030 trailing a CAGR of 13.6% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 5.3% and 8.3% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 6.1% CAGR.

- Ceramic tiles consist of clays and organic materials such as sand, quartz, and water. These tiles are commonly employed for bathroom walls and kitchen floors in homes, businesses, restaurants, and other establishments. They come in diverse styles and are easy to install, clean, and upkeep. Ceramic tiles find applications in both residential and non-residential settings within the building and construction industry. Their primary function is to fulfill the aesthetic requirements of buildings. Ceiling tiles are offered in different variations including porcelain, glazed, and unglazed options.

Market Drivers:

The construction industry is set to benefit from increased investment, leading to market growth.

Investing in infrastructure plays a crucial role in stimulating global and regional economies. Projections indicate a significant rise in capital projects and infrastructure spending over the next decade. Countries such as the US, China, Japan, Germany, Australia, Canada, India, Indonesia, Brazil, and Spain are committing substantial resources to the construction industry, aiming to achieve rapid and sustained economic development. Adequate investment in infrastructure is essential for modernizing and commercializing economic activities.

The trend of rapid urbanization in emerging markets like China, India, Brazil, Malaysia, and Indonesia further contributes to increased spending in vital infrastructure sectors, including hospitality, healthcare, retail, and transportation. The growing prosperity in these emerging markets is expected to drive the ceramic tiles industry.

For a comprehensive overview of industry value, including construction, please refer to the table below, which presents the value added in USD million.

Market Restraints:

In the UK and the EU, the requirements for ceramic tiles are determined by the EN 14411 standard, which is based on the international standard ISO 13006. On the other hand, in the US, the ANSI 137 standard sets the requirements. These standards play a crucial role in categorizing, defining, and classifying ceramic tiles into different groups. Each group has specific values for various properties such as chemical resistance, stain resistance, dimensions, breaking strength, water absorption, surface abrasion, cracking resistance, and anti-slip characteristics. The norm establishes the values that tiles must adhere to and the corresponding test methods for each defined group.

In European regulations, ceramic tiles are divided into various classes, specifying the characteristics that need to be controlled and the tolerances for each characteristic. However, some limits for certain properties have not been explicitly defined and are subject to agreement between the manufacturer and purchaser.

Market Opportunity:

The construction industry is experiencing growth in emerging countries such as China, India, and Russia, driven by rapid industrialization, favorable government policies, expanding foreign investments, increasing disposable income, and a growing focus on interior decoration. This growth, in turn, has led to an increased demand for ceramic tiles in these economies.

China, in particular, is witnessing significant economic growth, which is fueling the real estate market and driving the demand for floor-covering products. According to the International Trade Administration, China holds the position of the largest construction market worldwide. Similarly, India is also experiencing robust growth in the construction industry, supported by favorable government policies, foreign direct investment (FDI) in construction development, and a growing population. These factors are expected to further boost the domestic construction sector, leading to an increased demand for ceramic tile products in India.

Overall, the combination of favorable economic conditions, government support, and investment opportunities in emerging economies is driving the growth of the construction industry and creating a strong demand for ceramic tiles.

Ceramic Tiles Market 2023:

- The residential segment has shown the highest compound annual growth rate (CAGR) in the ceramic tiles market during the forecast period. This is primarily driven by an increase in new construction projects, housing renovation and remodeling activities, and rising disposable income levels. Ceramic tiles are widely preferred in residential settings due to their durability and easy maintenance. They are commonly used for flooring in areas such as kitchens, bathrooms, living rooms, dining spaces, and bedrooms. With the steady growth of housing renovation and maintenance, fueled by increasing disposable income, the demand for ceramic tiles in the residential sector is expected to continue rising.Among different types of ceramic tiles, the porcelain segment has demonstrated the highest CAGR during the forecast period. Porcelain tiles are in high demand due to their desirable properties such as low water absorption, slip resistance, and anti-bacterial features. They are popular in both residential and commercial buildings. Glazed porcelain tiles, unglazed porcelain tiles, and full-body porcelain tiles are commonly used, especially for heavy-duty flooring applications. The through-body composition of unglazed porcelain tiles ensures that any chips or damage may be less noticeable compared to ceramic tiles.The Asia Pacific region is projected to exhibit the highest CAGR in the ceramic tiles market during the forecast period. This region, including countries like India, China, Vietnam, Indonesia, and others, has witnessed rapid growth in the market. Factors contributing to this growth include increasing building and construction activities, investments from domestic and foreign investors, and a growing population. China and India, in particular, are experiencing significant growth in construction, both in the public and private sectors, which drives the demand for ceramic tiles.In terms of applications, the floor tiles segment has shown the highest growth rate during the forecast period. Ceramic tiles are preferred for flooring due to their strength, water resistance, and low maintenance requirements. They are extensively used in healthcare centers, government offices, sports institutes, and residential buildings. Ceramic tiles provide aesthetic appeal, durability, and cost-efficiency, making them a popular choice for new residential construction and commercial projects. Their moisture resistance and ease of cleaning make them particularly suitable for kitchen and bathroom floors. With a wide range of sizes, colors, shapes, and textures available, ceramic tiles offer functional and aesthetic benefits to consumers.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2028, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

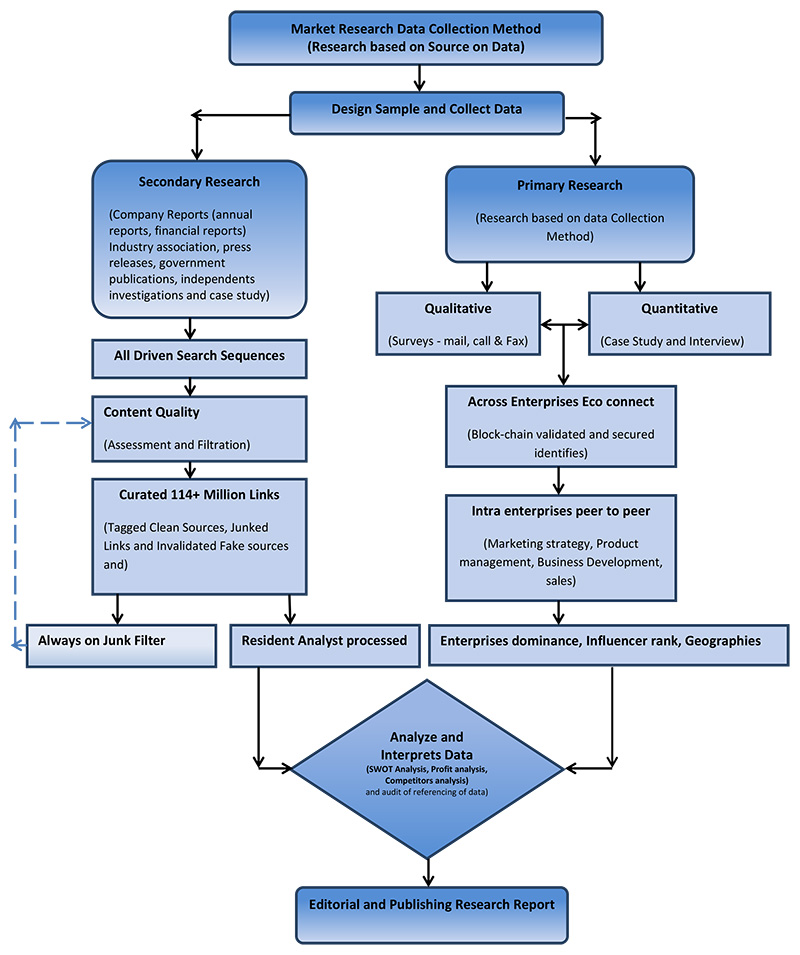

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- Marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2022 | USD 383.1 Billion |

| Revenue forecast in 2030 | USD 771.2 Billion |

| Growth Rate | CAGR of 9.16% from 2023 to 2030 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2021 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2022 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Type, Finish, Technology, Application, End Use industry & Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | Atlas Concorde S.p.A.; British Ceramic Tile; Canteras Cerro Negro SA; Cecrisa S.A; Century Tiles Ltd.; Cerâmica Carmelo For; Ceramica Cleopatra Group; Ceramiche Atlas Concorde S.p.A.; Ceramiche Marca; Corona S.p.A.; Ceramiche Refin S.p.A; Ceramiche Ricchetti Group; Ceramika Tubadzin II Sp. z o.o; Cersanit S.A.; China Ceramics Co. Ltd.; Clayhaus Ceramics; Corona Group; Cristal Cerámica S.A.; Crossville, Inc.; Daltile Corporation; Del Conca Group; Dongpeng; Dynasty Ceramic Public Company; Eliane Revestimentos Ceramicos; Emser Tile LLC; Florida Tile, Inc.; Florim USA Inc.; GranitiFiandre S.p.A.; Grespania SA; Grupo Cedasa; Grupo Fragnani; Grupo Uralita; Gruppo Ceramiche Ricchetti SpA; Gruppo Concorde S.p.A; H & R Johnson; Huida Sanitary Ware Co., Ltd.; Ilva S.A.; Internacional De Ceramica SA DE CV; Iris Ceramica S.p.A.; Johnson Tiles; Kajaria Ceramics; Kaleseramik Seramik San. ve Tic. A.Ş.; KERABEN Grupo; Lamosa Grupo; Lasselsberger GmbH; Malaysian Mosaics Berhad; Mannington Mills Inc.; Manufacturas Vitromex, S.A. de C.V.; Marazzi Group S.p.A.; Mohawk Industries Inc.; Mulia Inc.; Nitco Limited; Pamesa Ceramica SL; Panariagroup Industrie Ceramiche S.p.a.; Pavigres – Paviporto, S.A.; Pergo AB; Pilkington Group Plc; Porcelanite-Lamosa; Porcelanosa Grupo; Portobello SA; PT Arwana Citramulia Tbk; RAK Ceramics Co.; Ras Al Khaimah Ceramics; Roca Sanitario S.A.; Rovese S.A.; Saloni Ceramica; Saudi Ceramic Company; SCG Ceramics; Shaw Industries Group Inc.; Siam Cement Group (SCG); Somany Ceramics Ltd.; The Celima (Trebol Group); Villeroy & Boch AG; Vitromex; White Horse Ceramic Industries Sdn Bhd; and others |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

Ceramic Tiles Market, By Type:

- Porcelain

- Glazed

- Unglazed

- Scratch Free

- Others

Ceramic Tiles Market, By Application:

- Floor

- Internal Wall

- External Wall

- Others

Ceramic Tiles Market, By End-use:

- Residential

- Non-residential

Ceramic Tiles Market, By Finish:

- Matt

- Gloss

Ceramic Tiles Market, By Construction type:

- New construction

- Renovation

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

- Rest of the World

Companies Covered in Report:

| Atlas Concorde S.p.A. | Iris Ceramica S.p.A. |

| British Ceramic Tile | Johnson Tiles |

| Canteras Cerro Negro SA | Kajaria Ceramics |

| Cecrisa S.A | Kaleseramik Seramik San. ve Tic. A.Ş. |

| Century Tiles Ltd. | KERABEN Grupo |

| Cerâmica Carmelo For | Lamosa Grupo |

| Ceramica Cleopatra Group | Lasselsberger GmbH |

| Ceramiche Atlas Concorde S.p.A. | Malaysian Mosaics Berhad |

| Ceramiche Marca Corona S.p.A. | Mannington Mills Inc. |

| Ceramiche Refin S.p.A | Manufacturas Vitromex, S.A. de C.V. |

| Ceramiche Ricchetti Group | Marazzi Group S.p.A. |

| Ceramika Tubadzin II Sp. z o.o | Mohawk Industries Inc. |

| Cersanit S.A. | Mulia Inc. |

| China Ceramics Co. Ltd. | Nitco Limited |

| Clayhaus Ceramics | Pamesa Ceramica SL |

| Corona Group | Panariagroup Industrie Ceramiche S.p.a. |

| Cristal Cerámica S.A. | Pavigres – Paviporto, S.A. |

| Crossville, Inc. | Pergo AB |

| Daltile Corporation | Pilkington Group Plc |

| Del Conca Group | Porcelanite-Lamosa |

| Dongpeng | Porcelanosa Grupo |

| Dynasty Ceramic Public Company | Portobello SA |

| Eliane Revestimentos Ceramicos | PT Arwana Citramulia Tbk |

| Emser Tile LLC | RAK Ceramics Co. |

| Florida Tile, Inc. | Ras Al Khaimah Ceramics |

| Florim USA Inc. | Roca Sanitario S.A. |

| GranitiFiandre S.p.A. | Rovese S.A. |

| Grespania SA | Saloni Ceramica |

| Grupo Cedasa | Saudi Ceramic Company |

| Grupo Fragnani | SCG Ceramics |

| Grupo Uralita | Shaw Industries Group Inc. |

| Gruppo Ceramiche Ricchetti SpA | Siam Cement Group (SCG) |

| Gruppo Concorde S.p.A | Somany Ceramics Ltd. |

| H & R Johnson | The Celima (Trebol Group) |

| Huida Sanitary Ware Co., Ltd. | Villeroy & Boch AG |

| Ilva S.A. | Vitromex |

| Internacional De Ceramica SA DE CV | White Horse Ceramic Industries Sdn Bhd |

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2022 base year report.

- Free Updated edition of 2023 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions that are answered in this report

- What are the major drivers driving the growth of the Ceramic tiles Market?

- What are the major challenges in the Ceramic tiles Market?

- What are the restraining factors in the Ceramic tiles Market?

- What is the key opportunity in the Ceramic tiles Market?