Report Overview

- Understand the latest market trends and future growth opportunities for the Conductive Inks industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Conductive Inks Market” by various segments at a global and regional level for the 2010-2027 period, with 2010-2022 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2027 as forecast period.

Description:

- The growth in printed/flexible/hybrid electronics, especially where it enables new applications and even business models such as electronic skin patches for remote health monitoring and smart packaging, will drive the growth of the conductive ink market over the next decade. Furthermore, many emerging applications, such is in-mold electronics, e-textiles and high-frequency antennas, have specific ink requirements that provides an opportunity for differentiation.

- In the changed post COVID-19 business landscape, the global market for Conductive Inks estimated at US$3.6 Billion in the year 2021, is projected to reach a revised size of US$4 Billion by 2027, growing at a CAGR of 4% over the analysis period 2021-2027. Silver Ink, one of the segments analyzed in the report, is projected to record a 4.7% CAGR and reach US$1.6 Billion by the end of the analysis period. Considering the ongoing post pandemic recovery, growth in the Carbon / Graphene segment is readjusted to a revised 4% CAGR for the next 7-year period.

- The Conductive Inks market in the U.S. is estimated at US$819.6 Million in the year 2021. China, the world`s second largest economy, is forecast to reach a projected market size of US$812.9 Million by the year 2027 trailing a CAGR of 6.5% over the analysis period 2021 to 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.2% and 3.2% respectively over the 2021-2027 period. Within Europe, Germany is forecast to grow at approximately 2.9% CAGR. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$522.6 Million by the year 2027.

- In the global Carbon Nanoparticle segment, USA, Canada, Japan, China and Europe will drive the 3.2% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$339.4 Million in the year 2021 will reach a projected size of US$418.3 Million by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Latin America will expand at a 3.4% CAGR through the analysis period.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2027, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The Conductive Inks Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

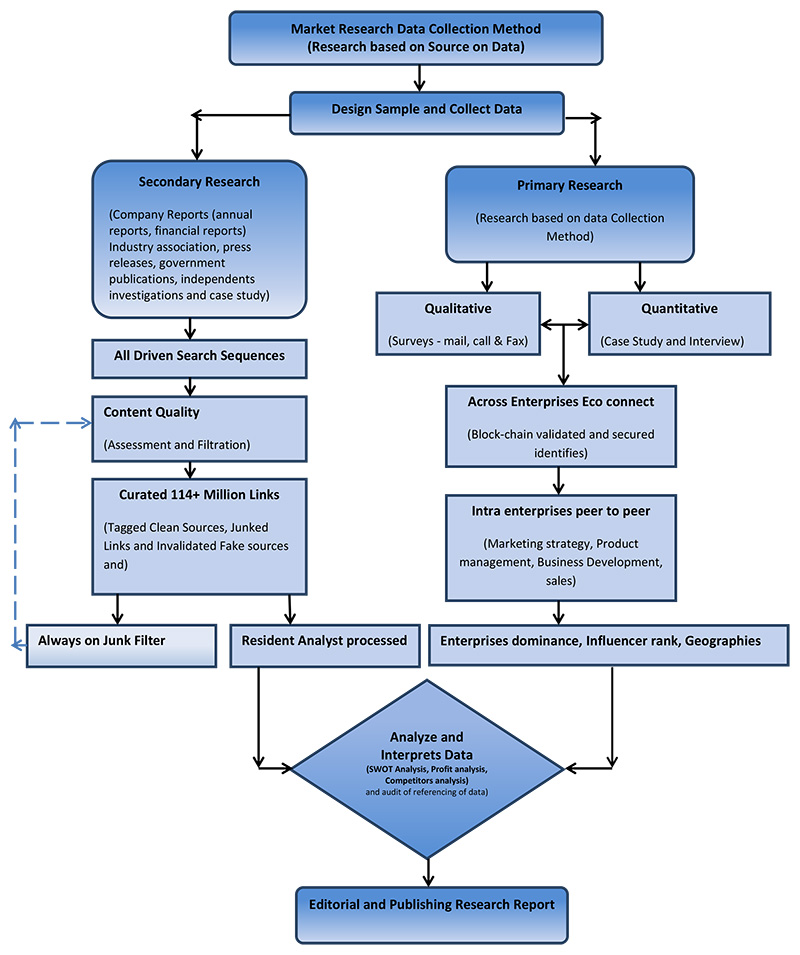

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2021 | USD 3.6 Billion |

| Revenue forecast in 2027 | USD Billion |

| Growth Rate | CAGR of 4% from 2023 to 2027 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2022 |

| Forecast period | 2023 – 2027 |

| Quantitative units | Revenue in USD million and CAGR from 2023 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth InitiativesCOVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews.

Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Product, Type, Technology, Application, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | ACI Materials; Advanced Nano Products; Agfa-Gevaert NV; American Elements; Applied Nanotech Holdings, Inc.; Bando; BASF SE; C3 Nano; Cambrios; ChemCubed; Copprint; Creative Materials, Inc.; DuPont; Dycotec; E2IP; Elantas; Electroninks; Engineered Materials Systems; Epoxies, Etc; EverZinc; Fujikura Ltd.; GenseInk; Griller-Werke AG; Henkel Ag & Co. KgaA; Heraeus Holding; Inframat Advanced Material LLC; Inkron; InkTec; Johnson Matthey Colour Technologies; Lanxess Corporation; Liquid Wire; Liquid X; Mateprincs; Methode Electronics; Micronisers Pty Ltd; Nagase America Corporation; Nano Dimension; Nano Labs; NanoCnet; Nanophase Technologies Corporation; NanOrbital; N-ink; Novacentrix; OrelTech; Pan-Continental Chemical Co. Ltd.; PChem Associates, Inc.; Poly-Ink; PPG Industries, Inc.; PrintCB; Promethean Particles; PVNanoCell; Sakai Chemical Industry Co. Ltd.; Saralon; Showa Denko Materials Co. Ltd.; Sigma-Aldrich Co. LLC; Sun Chemical Corporation; U.S. Research Nanomaterials Inc.; Umicore N.V.; UT Dots; Vorbeck Materials Corp.; Voxel8; Zero Valent Nano Metals and others |

| Customization scope | Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2021 – 2027)

- Conductive silver ink

- Conductive copper ink

- Conductive polymers

- Carbon nanotube ink

- Dielectric inks

- Carbon/Graphene ink

- Others

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2019 – 2030)

- Photovoltaic

- Membrane switches

- Displays

- Automotive

- Smart packaging

- Biosensors

- Printed circuit boards

- Other applications

Key Market Players

| ACI Materials | Griller-Werke AG | OrelTech |

| Advanced Nano Products | Henkel Ag & Co. KgaA | Pan-Continental Chemical Co. Ltd. |

| American Elements | Heraeus Holding | PChem Associates, Inc. |

| Applied Nanotech Holdings, Inc. | Inframat Advanced Material LLC | Poly-Ink |

| Bando | Inkron | PPG Industries, Inc. |

| BASF SE | InkTec | PrintCB |

| C3 Nano | Johnson Matthey Colour Technologies | Promethean Particles |

| Cambrios | Lanxess Corporation | PVNanoCell |

| ChemCubed | Liquid Wire | Sakai Chemical Industry Co. Ltd. |

| Copprint | Liquid X | Saralon |

| Creative Materials, Inc. | Mateprincs | Showa Denko Materials Co. Ltd. |

| DuPont | Methode Electronics | Sigma-Aldrich Co. LLC |

| Dycotec | Micronisers Pty Ltd | Sun Chemical Corporation |

| E2IP | Nagase America Corporation | U.S. Research Nanomaterials Inc. |

| Elantas | Nano Dimension | Umicore N.V. |

| Electroninks | Nano Labs | UT Dots |

| Engineered Materials Systems | NanoCnet | Vorbeck Materials Corp. |

| Epoxies, Etc | Nanophase Technologies Corporation | Voxel8 |

| EverZinc | NanOrbital | Zero Valent Nano Metals |

| Fujikura Ltd. | N-ink | |

| GenseInk | Novacentrix |

Recent Developments

- On March 21, 2022, DuPont (NYSE:DD) Microcircuit and Component Materials (MCM) business announced the launch of new Silver/Silver Chloride (Ag/AgCl) conductive ink/paste for health care applications. The 5881 Silver/Silver Chloride conductive paste is used in the health care field to meet the increased needs of doctors and patients that utilize these devices every day by helping them provide confidence in real time information on the health of the patient.

- On September 9, 2020, Nanotech Energy Inc., a manufacturer of the purest graphene, announced it had developed and scaled a process for the production of graphene with more than 90% of its content being monolayers, the purest form of graphene available in mass production quantities. Nanotech plans to install two graphene product lines to address the market need for graphene sheets with low oxygen content. The first product line is expected to contain an oxygen content of nearly 13%-15%, while the second product line is likely to contain just 3% oxygen content.

- On May 29, 2020, Creative Materials Inc., based in Ayer, Massachusetts, the U.S., introduced a new gold conductive ink, coating, and adhesive. This substance adheres well to smooth high-energy surfaces such as polyimide, polyester, and glass. Unlike traditional gold inks, CMI’s 128-24 provides excellent coverage at a moderate cost. Working electrodes, transdermal medication delivery, electrochemical sensors, tens electrodes, and muscle stimulation devices are some of its applications. When smooth surfaces or fine features are not required, the substance is helpful in printing non-oxidizing gold electrodes.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2021 base year report.

- Free Updated edition of 2023 without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions answered in this report

- What types of conductive inks are produced by each supplier?

- How will rising silver prices impact the conductive ink market?

- What are the requirements for each conductive ink application, and how much ink is used in each?

- What is the technological and market readiness of each conductive ink application?

- What are the key growth opportunities where there is scope for differentiation