Report Overview

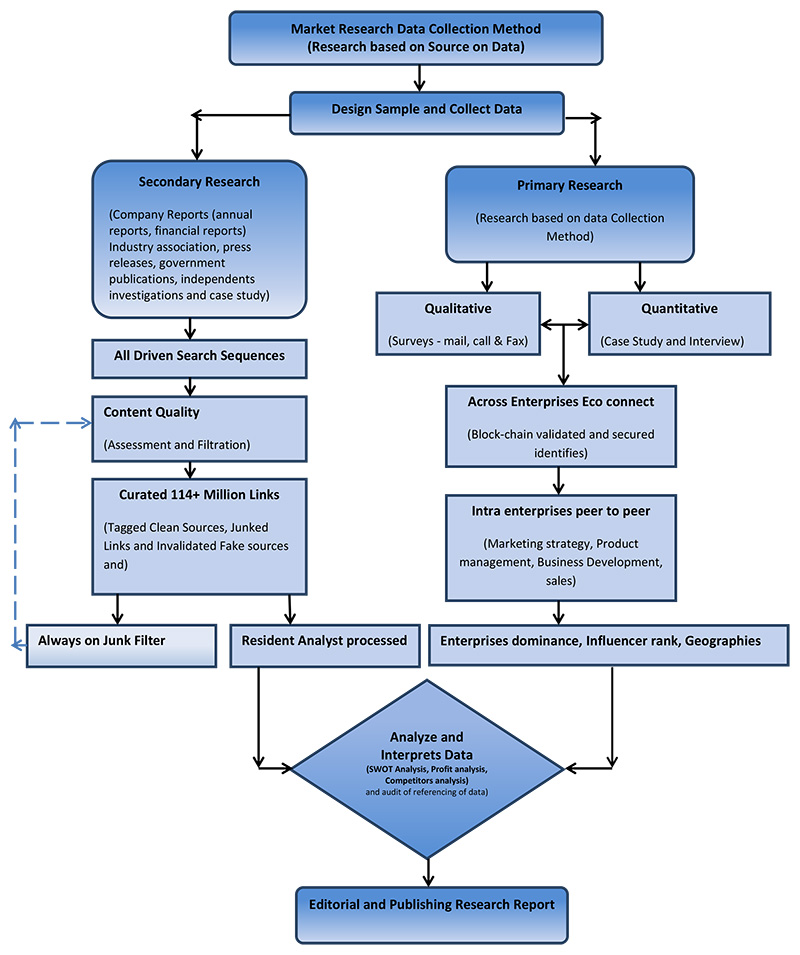

- Understand the latest market trends and future growth opportunities for the Generative AI industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Generative AI Market” by various segments at a global and regional level for the 2010-2028 period, with 2010-2021 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2028 as forecast period.

Description:

- According to GIR Research, the generative AI market is projected to experience substantial growth, increasing from USD 11.3 billion in 2023 to USD 51.8 billion by 2028. This represents a compound annual growth rate (CAGR) of 35.6% over the forecast period. The market for generative AI is expected to witness significant expansion due to several factors that drive its growth. These factors include the continuous evolution of artificial intelligence (AI) and deep learning technologies, the emergence of content creation and creative applications, and the innovation of cloud storage, which enables convenient access to data. These business drivers contribute to the rapid development and adoption of generative AI, leading to its robust growth in the market.

The generative AI market report provides insights into the technology roadmap for generative AI until 2030, highlighting the initiation, development, and commercialization of technologies across various domains such as text, code, images, and video/3D/gaming.

Key findings from the technology roadmap are as follows:

Short-term technology roadmap (2023-2025):

- Technological advancements in language modeling to enhance natural language generation and understanding capabilities.

- Improvements in generative adversarial networks (GANs) for more robust and realistic generation of content.

Mid-term technology roadmap (2026-2028):

- Advances in meta-learning and few-shot learning techniques, enabling generative AI systems to learn from limited data and adapt quickly to new tasks.

- Development of generative AI systems capable of learning from multi-modal data, integrating different types of information such as text, images, and audio.

Long-term technology roadmap (2029-2030):

- Emergence of fully autonomous generative AI systems capable of independent decision-making and creative output generation.

- Increased utilization of generative AI in scientific research, enabling new discoveries and insights across various fields.

The report also includes generative AI business models across different use cases, providing a comprehensive view of how generative AI is being applied and commercialized in various industries.

Market Drivers:

The innovation of cloud storage has revolutionized data accessibility, allowing previously restricted data to be made available to the public. In the past, data scientists faced significant costs and challenges when accessing data for research purposes. However, with the widespread adoption of cloud storage, governments, research institutes, and businesses have unlocked valuable data that was once confined to tape cartridges and magnetic disks.

This easy access to data is particularly advantageous for data scientists working on generative AI, as they require substantial amounts of data to achieve accurate and efficient machine learning model training. With readily available data, research facilities can now train machine learning models to tackle complex problems using the data at their disposal.

Generative AI, in particular, can leverage cloud storage to generate new data more quickly and cost-effectively. This capability proves valuable in tasks such as data organization, processing, augmentation, synthesis, and generation for underrepresented or unrepresented groups. Additionally, generative AI can assist in data analysis and the comprehension of complex systems.

Notable applications of generative AI utilizing cloud storage include converting satellite images into map views for exploring new locations, transforming medical images into photo-realistic representations, and generating marketing data based on collected information about target markets or consumer behaviors. The availability of cloud storage has greatly facilitated these applications and expanded the possibilities for data-driven research and innovation.

Market Restraints:

One of the major risks associated with generative AI projects is the potential for data breaches and sensitive information leaks. Data security concerns have been a significant barrier to the expansion of the generative AI market, especially with the increasing stringency of data confidentiality regulations worldwide.

Generative AI projects often involve the use of unstructured data, which may include personal information such as faces, vehicle license plates, or sensitive medical data. If this data is not appropriately secured, it can lead to serious data breaches and privacy violations.

Outsourcing generative AI projects can introduce additional data security challenges. Many enterprises work with freelancers or third-party service providers located in different locations, which can complicate data security measures. Data security firm Trustwave estimates that a significant portion of data thefts (approximately 63%) occur due to a lack of due diligence when outsourcing data to third-party providers.

Crowdsourcing platforms, commonly used for data training in generative AI projects, may not always prioritize data security policies. Data annotators working on these platforms may access data through insecure personal devices, download or transfer it to unknown storage locations, or work on data using public Wi-Fi networks, which increases the risk of data theft.

To mitigate these risks, it is essential for enterprises and organizations involved in generative AI projects to prioritize data security and take necessary precautions. This includes implementing strong data security policies, conducting due diligence when selecting outsourcing partners, and ensuring secure data transmission and storage protocols are in place. Additionally, proper training and awareness programs for data annotators and stakeholders can help prevent inadvertent data breaches and improve overall data security in generative AI projects.

Market Opportunity:

The deployment of Large Language Models (LLMs) and other generative machine learning tools has experienced significant acceleration, leading to streamlined content creation processes. LLMs, which are complex neural networks capable of generating text, form the foundation of systems like OpenAI’s GPT-3 for text generation, Google’s LaMDA for conversational dialogue, and OpenAI’s DALL-E and Mid journey for text-to-image generation. These LLMs have been rapidly advancing in size and sophistication, growing approximately 10 times larger each year.

As a result, modern AI can autonomously generate content across various mediums such as text, visuals, audio, code, data, and multimedia, reaching a level on par with human benchmarks. Currently, AI-generated content accounts for less than 1% of online content. However, it is projected that within the next decade, at least 50% of online content will be either generated or augmented by AI.

Generative AI and LLMs are driving a significant paradigm shift in content creation, communication, and knowledge generation. Similar to how cloud computing and smartphones transformed industries and created new opportunities, generative AI is poised to have a similar impact. Cloud computing, for instance, went from less than 5% of software spending to approximately 30% within a decade. Likewise, US smartphone penetration grew from 1% to 55%. Generative AI has broad applications across multiple sectors, including media, communications, software, life sciences, and more. It offers both cost savings and higher value in many use cases, suggesting that adoption could happen even more rapidly than anticipated.

Challenges:

Generative AI indeed presents complexity and technical challenges that can hinder its understanding, adoption, and implementation. Many people lack knowledge about how generative AI works and struggle to grasp its usage and implementation processes. This lack of familiarity can discourage small businesses from adopting generative AI due to the perceived complexity and unfamiliarity of the technology.

While free services like ChatGPT and Dall-E provide access to generative AI capabilities, they have their limitations. For instance, ChatGPT experiences downtimes during peak usage, affecting its availability. Dall-E offers a limited number of free image generations per user, with subsequent usage further restricted. Paid services, on the other hand, offer more reliability and flexibility, but selecting the most reliable and suitable AI companies or services from the multitude of options available since 2020 can be challenging.

Implementing in-house generative AI capabilities poses its own set of technical challenges. The computational requirements of generative AI models can be significant, resulting in computational expenses and inefficiencies. Ensuring efficient utilization of resources and optimizing the performance of these models can be demanding and require expertise.

Overcoming these complexity and technical challenges associated with generative AI involves enhancing education and awareness about the technology, carefully evaluating available AI services, and addressing the computational requirements through effective resource management and optimization strategies. As the field progresses, advancements in user-friendly interfaces, improved reliability, and more efficient models are likely to alleviate some of these challenges and make generative AI more accessible and practical for a wider range of users.

Generative AI Market 2023:

- During the forecast period, the generative AI software segment is expected to account for a larger market size. Generative AI software is currently utilized in various applications such as natural language processing, image generation, and generative design. As robust machine learning models enhance the capabilities of generative AI, the software segment is anticipated to play a significant role in industries like entertainment, fashion, and transportation. For example, H&M utilizes generative AI software to create personalized clothing designs based on customers’ unique preferences and style.

- The synthetic data generation segment is projected to register the highest compound annual growth rate (CAGR) during the forecast period. This growth can be attributed to the increasing demand for high-quality training data to develop accurate and robust AI models. Synthetic data generation technology enables organizations to generate large volumes of diverse, labeled, and precise synthetic data, which finds applications across various industries.

- In terms of market size, North America is expected to lead the generative AI market in 2023. The United States, in particular, holds the largest market share in North America. The region’s market dominance is driven by factors such as the rising demand for AI-generated content in industries like media and entertainment, the growing adoption of AI in healthcare and other sectors, and the availability of substantial data for training generative models.

- Furthermore, North America benefits from a robust ecosystem of AI-focused startups and venture capitalists, fostering innovation in the field. Many prominent companies in the generative AI market, including OpenAI, Nvidia, and Google, are based in North America.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2028, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- Marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2023 | USD 11.3 Billion |

| Revenue forecast in 2028 | USD 51 Billion |

| Growth Rate | CAGR of 35.6% from 2023 to 2028 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2021 |

| Forecast period | 2023 – 2028 |

| Quantitative units | Revenue in USD million and CAGR from 2022 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Type, Technology, Offering, Application & Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | Accenture; Adobe; Amazon; Apple; Autodesk; AWS; Baidu; Brandmark.io; Character.AI; Codacy; Deep AI; DeepMind; Dialpad; Eleuther AI; Excel Formula Bot; FireFlies; Fontjoy; Fujitsu; Galileo; Genie AI; GFP-GAN; GIPHY; Google; Huawei; IBM; Insilico Medicine; Intel; JetBrains; Lightricks; Lumen5; Magic Studio; Media.io; META; Microsoft; Midjourney; Morphis Technologies; Mostly AI; NVIDIA; OpenAI; Oracle; Paige.AI; Persado; Play.ht; Riffusion; Salesforce; Samsung; SAP; Siemens; Simplified; Speechify; Starry AI; Synthesia; Tencent; Twitter; Uber; Unity Technologies; Veesual and others |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

By Offering:

- Software

- Services

By Application:

- Natural Language Processing (NLP)

- Automated content creation

- Product Description

- Marketing Copy

- Sentiment Analysis

- Language Translation

- ML-based Predictive Modeling

- Predictive Analytics

- Personalized Recommendations

- Computer Vision

- Object Recognition

- Image & Video Analysis

- Surveillance

- Robotics and Automation

- Assembly Line Production

- Material Handling

- Speech Recognition

- Speech-to-Text Conversion

- Call Center Automation

- Music and Art Generation

- Automated Music Composition

- Visual Art

- Graphics Design

- Education and Training

- Finance and Accounting

- Fraud Detection and Risk Assessment

- Investment Analysis and Financial Forecasting

- Compliance Monitoring

- Legal

- Contact Analysis and Review

- Legal Research and Analysis

- Automated Document Summarization

- Customer Service and Support

- Chatbots

- Voice Assistants

- Automated Ticket Resolution

- Augmentaed Reality (AR) and Virtual Reality (VR)

- Virtual Object Creation

- Virtual Environment Creation

- Personalized Avatar Creation

- Training and Simulation

- Synthetic Data Generation

- Autonomous System Training

- Medical Imaging

- Cybersecurity

- Product Design

- Precision Agriculture

- Environmental Sustainibility

- Video Editing/Generation

- Automated Video Editing

- Virtual Set Design

- Special Effects and Animation

- 3D Modeling and Reconstruction

- Image and Texture Synthesis

- 2D to 3D Model Generation

- 3D Model Simulations

- Game Design and Character Production

- Procedural Content Generation

- Non-Player Character Generation

By Vertical:

- Media and Entertainment

- Gaming

- Publishing Agencies

- Print and Electronic Media

- Transportation and Logistics

- Air

- Road

- Rail

- Maritime

- Third Party Logistics (3PL)

- Manufacturing

- Discrete Manufacturing

- Process Manufacturing

- Healthcare and Life Sciences

- Healthcare Institutes

- Healthcare Device Manufacturing

- Pharmaceutical and Lifesciences

- Medical Research

- IT and ITES

- Construction and Real Estate

- BFSI

- Banking

- Financial Services and Fintech

- Insurance

- Energy and Utilities

- Oil and Gas

- Utilities

- Mining

- Retail and Ecommerce

- Government and Defense

- Public Sector

- Military and Defense

- Other Verticals

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

- Rest of the World

Companies Covered in Report:

| Accenture | Lumen5 |

| Adobe | Magic Studio |

| Amazon | Media.io |

| Apple | META |

| Autodesk | Microsoft |

| AWS | Midjourney |

| Baidu | Morphis Technologies |

| Brandmark.io | Mostly AI |

| Character.AI | NVIDIA |

| Codacy | OpenAI |

| Deep AI | Oracle |

| DeepMind | Paige.AI |

| Dialpad | Persado |

| Eleuther AI | Play.ht |

| Excel Formula Bot | Riffusion |

| FireFlies | Salesforce |

| Fontjoy | Samsung |

| Fujitsu | SAP |

| Galileo | Siemens |

| Genie AI | Simplified |

| GFP-GAN | Speechify |

| GIPHY | Starry AI |

| Synthesia | |

| Huawei | Tencent |

| IBM | |

| Insilico Medicine | Uber |

| Intel | Unity Technologies |

| JetBrains | Veesual |

| Lightricks |

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2022 base year report.

- Free Updated edition of 2023 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions that are answered in this report

- What is generative AI?

- What is the total CAGR expected to be recorded for the generative AI market during 2023-2028?

- Which are the key drivers supporting the growth of the generative AI market?

- Which are the key technology trends prevailing in the generative AI market?

- Who are the key vendors in the generative AI market?