Report Overview

- Understand the latest market trends and future growth opportunities for the 3D Printing industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “3D Printing Market” by various segments at a global and regional level for the 2010-2030 period, with 2010-2023 as historical data, 2023 as a base year, 2024 as an estimated year and 2024-2030 as forecast period.

- 10-year forecast lines across 17 3D printing technologies and 10 3D printing material types. Includes technology breakdowns, market analysis, bench marking studies, player profiles for polymer, metal, ceramic, composite, and construction 3D printing.

Description:

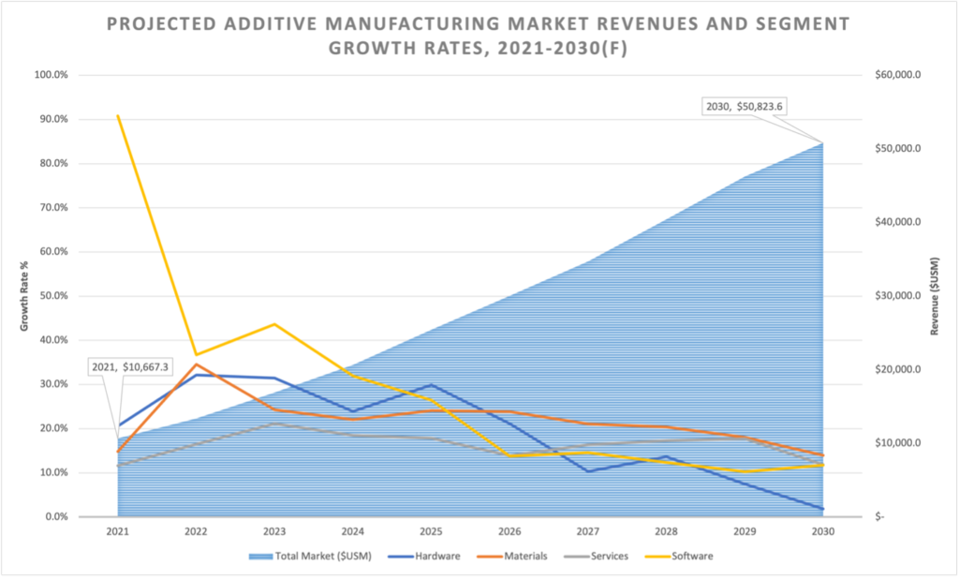

- The global market for 3D Printers estimated at US$14.7 Billion in the year 2023, is expected to reach US$41.9 Billion by 2030, growing at a CAGR of 16.1% over the analysis period 2023-2030.

- Printers, one of the segments analyzed in the report, is expected to record a 13.5% CAGR and reach US$13.4 Billion by the end of the analysis period. Growth in the Services segment is estimated at 17.0% CAGR over the analysis period.

- The 3D Printers market in the U.S. is estimated at US$3.9 Billion in the year 2023. China, the world`s second largest economy, is forecast to reach a projected market size of US$11.4 Billion by the year 2030 trailing a CAGR of 23.6% over the analysis period 2023-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 11.8% and 13.1% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 12.1% CAGR.

- The global 3D printing materials market, valued at $4.8 billion in 2023, is projected to reach $17.6 billion by 2030, with a CAGR of 20.4%. The filament segment is expected to grow at 22.6% CAGR, reaching $9.7 billion, while the liquid segment will grow at 18.7% CAGR. The U.S. market is valued at $1.4 billion in 2023, and China is set to grow at 19.7% CAGR to $2.7 billion by 2030. Other key markets include Japan (18.3% CAGR), Canada (16.8%), and Germany (13.7%).

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2030, and Historical Data 2010- 2023

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

Technology trends, materials trends, & manufacturer analysis:

- Detailed summaries of all 3D printing technologies by material class

- Comparison studies between polymer 3D printers of different technologies and metal 3D printers of different technologies

- Analysis for polymer 3D printing materials, broken into three feedstock categories and seventeen individual feedstock types

- Comprehensive discussion of metal 3D printing materials on the market by different manufacturers

- Exploration of auxiliary 3D printing categories, like post-processing, software, scanners, and services

- Overview of additive manufacturing applications in key industries like electric vehicles, aviation, healthcare, space, automotive, and more

- Summaries of emerging printer technologies

- Primary interviews with key companies.

3D Printing Market Forecasts & Analysis:

- 10-year granular market forecasts of hardware by printer technology, material class, unit sales, install base

- Eighty forecast lines included across twelve forecasts

- 10-year granular market forecasts include polymer and metal materials demand and revenue by feedstock type

- Extensive discussion of the current economic climate’s effects on the 3D printing industry and the market’s current status through primary and secondary research analysis

3D Printing Materials Market 2024-2030: Forecast Segmentation:

- By material type: polymer, metal, ceramic, and construction

- By technology: 11 polymers, 10 metal, and 3 ceramic additive manufacturing technologies

- By polymer feedstock type: 6 photopolymer resin, 6 thermoplastic filament, and 5 thermoplastic powder categories

- By metal alloy composition: 9 metal alloy categories used in metal 3D printing

The 3D Printing Report Includes:

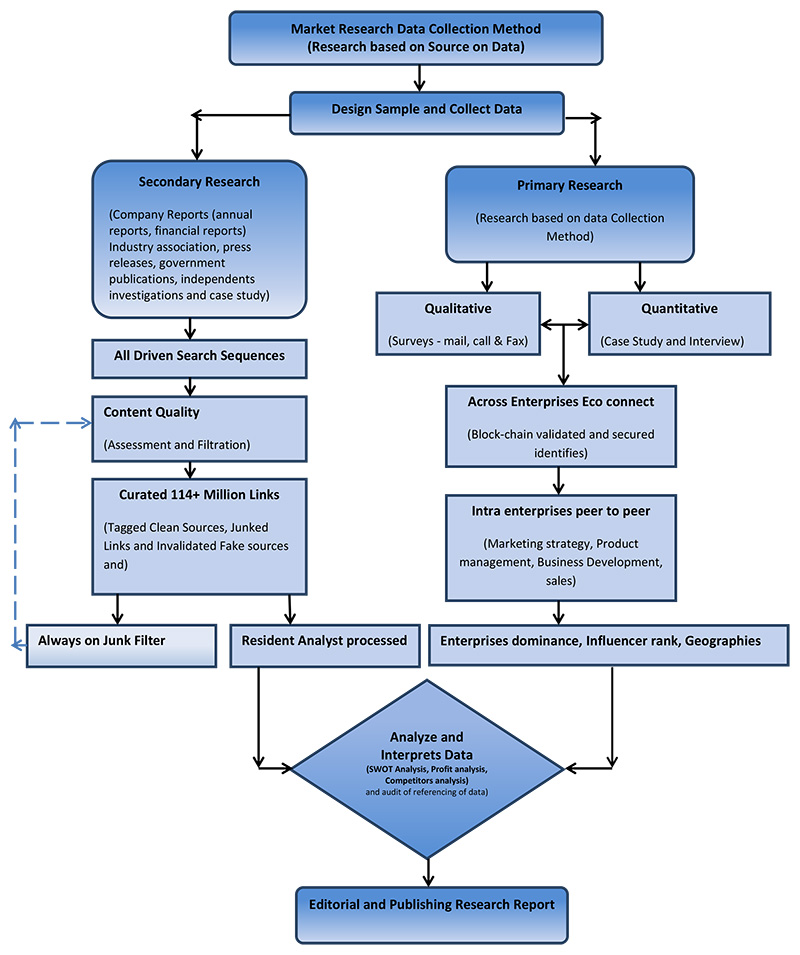

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, China, Japan, Germany, India, United Kingdom, France, Brazil, Italy, Canada, South Korea, Australia, Russia, Spain, Mexico, Indonesia, Netherlands, Switzerland, Saudi Arabia, Turkey, Taiwan, Poland, Sweden, Belgium, Thailand, Austria, Nigeria, Argentina, United Arab Emirates, Iran, Norway, Israel, Ireland, Malaysia, Denmark, Singapore, Philippines, Pakistan, Finland, Chile, Vietnam, Greece, Czech Republic, Romania, Portugal, Peru, New Zealand, Hungary, Iraq, Bangladesh, Qatar, Kuwait, Ukraine, Egypt, Kazakhstan, Colombia, Angola, Algeria, Morocco, Slovakia, Oman, Puerto Rico, Ethiopia, Sudan, Kenya, Ghana, Dominican Republic, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2023 | USD 14.7 Billion |

| Revenue forecast in 2030 | USD 41.9 Billion |

| Growth Rate | CAGR of 16.1% from 2024 to 2030 |

| Base year for estimation | 2023 |

| Historical data | 2010 – 2023 |

| Forecast period | 2024 – 2030 |

| Quantitative units | Printer and Materials Revenue (billions USD), Printers (units), Materials (kilotonnes) |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews. Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Product, Type, Component, Technology, Application, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, China, Japan, Germany, India, United Kingdom, France, Brazil, Italy, Canada, South Korea, Australia, Russia, Spain, Mexico, Indonesia, Netherlands, Switzerland, Saudi Arabia, Turkey, Taiwan, Poland, Sweden, Belgium, Thailand, Austria, Nigeria, Argentina, United Arab Emirates, Iran, Norway, Israel, Ireland, Malaysia, Denmark, Singapore, Philippines, Pakistan, Finland, Chile, Vietnam, Greece, Czech Republic, Romania, Portugal, Peru, New Zealand, Hungary, Iraq, Bangladesh, Qatar, Kuwait, Ukraine, Egypt, Kazakhstan, Colombia, Angola, Algeria, Morocco, Slovakia, Oman, Puerto Rico, Ethiopia, Sudan, Kenya, Ghana, Dominican Republic and others |

| Key companies profiled | 3D Systems, Inc.; 3DCeram; ARC Group Worldwide; Arcam AB; Arkema S.A.; Autodesk, Inc.; BASF 3D Printing Solutions; BCN3D Technologies; BigRep GmbH; Canon, Inc.; Carbon, Inc.; Clariant International Ltd.; Covestro AG; Dassault Systemes; Desktop Metal, Inc.; DSM Additive Manufacturing; DuPont; EnvisionTec, Inc.; EOS GmbH; Evonik Industries AG; Fast Radius; Fathom Digital Manufacturing Corp.; Formlabs; GE Additive; GKN Additive; Henkel AG & Co. KGaA; HP Inc.; Huntsman Corporation; Jabil Additive; Madeinspace; Markforged; Materialise NV; Mitsubishi Chemical Holdings Corp.; Nano Dimension Ltd.; Nexa3D; Optomec, Inc.; Organovo Holdings Inc.; Prodways Group; Proto Labs, Inc.; Protolabs; Quickparts; Rapid Shape GmbH; RapidMade; Renishaw plc.; Ricoh 3D; Royal DSM N.V.; SABIC (Saudi Basic Industries Corporation); Sculpteo; Shapeways, Inc.; Siemens Additive Manufacturing; SLM Solutions; Solvay S.A.; Stratasys Ltd.; Tiertime; Trumpf; Ultimaker; UnionTech; Victrex plc; voxeljet AG; Weerg; Xometry; XYZprinting; Zortrax and others. |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

By Material

- Polymer

- Metal

- Ceramic

- Composites

- Construction

By Component

- Hardware

- Material

- Software

- Services

By Printer Type

- Desktop 3D Printer

- Industrial 3D Printer

By Technology

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Polyjet Printing Multi-jet Printing (MJP)

- Inkjet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing

- Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Process:

- Powder Bed Fusion

- Vat Photopolymerization

- Binder Jetting

- Material Extrusion

- Material Jetting

- Other Processes

By Vertical Outlook

- Industrial 3D Printing

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Others

- Desktop 3D Printing

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

Companies Covered in Report:

| 3D Systems, Inc. | Mitsubishi Chemical Holdings Corp. |

| 3DCeram | Nano Dimension Ltd. |

| ARC Group Worldwide | Nexa3D |

| Arcam AB | Optomec, Inc. |

| Arkema S.A. | Organovo Holdings Inc. |

| Autodesk, Inc. | Prodways Group |

| BASF 3D Printing Solutions | Proto Labs, Inc. |

| BCN3D Technologies | Protolabs |

| BigRep GmbH | Quickparts |

| Canon, Inc. | Rapid Shape GmbH |

| Carbon, Inc. | RapidMade |

| Clariant International Ltd. | Renishaw plc. |

| Covestro AG | Ricoh 3D |

| Dassault Systemes | Royal DSM N.V. |

| Desktop Metal, Inc. | SABIC (Saudi Basic Industries Corporation) |

| DSM Additive Manufacturing | Sculpteo |

| DuPont | Shapeways, Inc. |

| EnvisionTec, Inc. | Siemens Additive Manufacturing |

| EOS GmbH | SLM Solutions |

| Evonik Industries AG | Solvay S.A. |

| Fast Radius | Stratasys Ltd. |

| Fathom Digital Manufacturing Corp. | Tiertime |

| Formlabs | Trumpf |

| GE Additive | Ultimaker |

| GKN Additive | UnionTech |

| Henkel AG & Co. KGaA | Victrex plc |

| HP Inc. | voxeljet AG |

| Huntsman Corporation | Weerg |

| Jabil Additive | Xometry |

| Madeinspace | XYZprinting |

| Markforged | Zortrax |

| Materialise NV | Others* |

Recent Developments

- October 2022: AML3D Australian metal 3D printing expanded its partnership with Boing aircraft manufacturer. Boeing tasked AML3D earlier this year with 3D printing aluminum prototype airplane components as part of an intensive testing procedure in which they were tested against the requirements of AS9100D quality assurance for ‘fly’ parts. Building on this contract, it has now been decided to broaden the scope of the project to include the provision of additional 3D-printed components, increasing the agreement’s value by 150%.

- October 2022: PostProcess Technologies and EOS have launched a distribution relationship to provide EOS clients with a fully automated and sustainable depowering solution. According to PostProcess, the Variable Acoustic Displacement (VAD) technology solution will complement the EOS printer product line and automate gross depowering for 3D printed parts. The partnership makes it easier for consumers to obtain post-printing solutions, allowing for complete process digitization.

- February 2022 – Imaginarium, one of the global leaders in 3D Printing solutions and advanced manufacturing technology, announced the launch of its desktop and industrial 3D printer range in partnership with 3D printing giant Ultimaker.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2023 base year report.

- Free Updated edition of 2024 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Analyst support post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions that are answered in this report

- What are the current and emerging printer technology types within different material specialties?

- How do metrics such as price, build speed, build volume and precision vary by printer type and material class?

- What are the strengths and weaknesses of different 3D printing technologies?

- Which printers support different material classes?

- What is the current installed base of 3D printers?

- Who are the main players?

- What are the current and emerging 3D printing materials in 2030?

- What are the strengths and weaknesses of different 3D printing materials?

- Which materials are supported by different printer technologies?

- How are polymer 3D printing material feedstocks further segmented?

- What are the potential applications of products made from 3D printing materials?

- What are the market shares of each material class?

- What are the key drivers and restraints of market growth?

- What is the projected demand by mass and annual revenue growth for materials from 2023 to 2030?