Global Train Control & Management Systems market – Overview

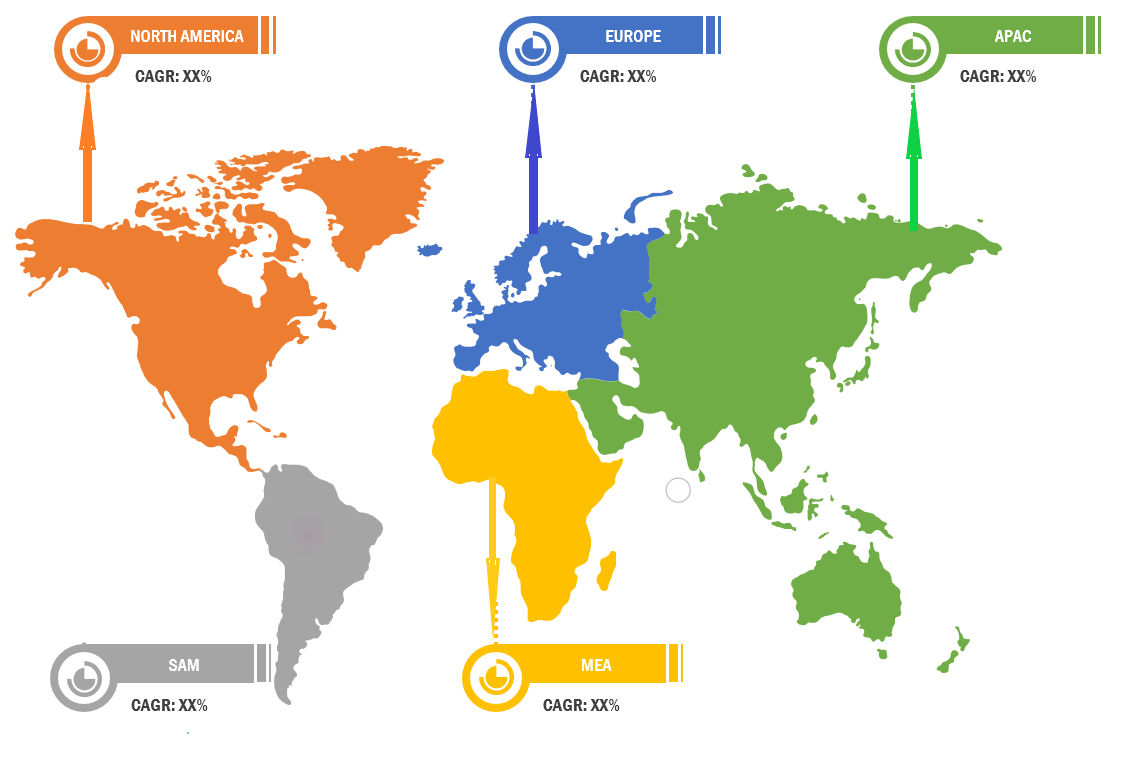

The report will cover the overall analysis and insights in relation to the size and growth rate of the “Global Train Control & Management Systems market ” by various segments at a global and regional level for the 2014-2027 period, with 2014-2019 as historical data, 2020 as a base year, 2021 as an estimated year and 2021-2027 as forecast period.

Global Train Control & Management Systems market – Introduction

Governments of different regions have already announced total lockdown and temporarily shutdown of industries, which adversely affected the overall production and sales. From March 2020, public transport in majority of the cities has been completely or partially shut down. Although the restrictions on public mobility have been lifted partially since the past two or three months, major cities are experiencing 70–90% reduction in the public transit ridership. Transportation has begun partially across the globe with stringent restrictions such as passenger limit and maintenance of social distancing. This results to 90% decrease in passenger ridership, and results in huge financial losses of rail operators. This financial losses result in focus on operational activities rather than new investment. Thus, COVID-19 outbreak has significant impact on the overall train control management system market.

Public transportation offers a range of benefits over private conveyance such as fluctuating fuel prices, traffic congestion, and greenhouse gas emissions. This leads to the increasing demand for high-speed rail transit network which is estimated to boost the market for TCMS. The TCMS market is driven by the factors such as growing urbanization and population in developing countries such as India and China and increasing availability of high-speed communication systems. Furthermore, TCMS increases the efficiency and reliability of trains and shortens their response time by automating the operations of the train & its subsystem and passenger safety.

Global Train Control & Management Systems market Report Scope

- The scope of the report covers the clear understanding and overview of the product.

- Analysis of market trends in the region, with market data considering 2020 as the base year, 2021 as the estimate year and forecast for 2027 with projection of CAGR from 2021 to 2027.

- The report covers discussion of economic trends and technology.

- Market estimates represent revenue.

- In-depth analysis of the market segmentation assists in determining the prevailing market scope.

- Also, the Train Control & Management Systems market analysis report includes information on upcoming trends and challenges that will influence market growth. This is to help companies strategize and leverage all forthcoming growth opportunities.

| Attribute | Details |

|---|---|

| Market size available for years | 2014–2027 |

| Base year considered | 2020 |

| Forecast period | 2021–2027 |

| Historical period | 2014-2019 |

| Forecast units | Value (USD) & Volume (Million Units) |

| Forecast units | Value (USD) & Volume (Million Units) |

| Segmentation | By Regions North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

| By Countries United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Indonesia, Malaysia, Switzerland, Australia, India, Italy, Sweden, Spain, Belgium, Netherlands, Norway, Brazil, Argentina, Mexico, South Africa and 54 Others. |

|

| By Solution Communication-Based Train Control, Positive Train Control and Integrated Train Control. |

|

| By Component Vehicle Control Unit, Human Machine Interface, Mobile Communication Gateway and Other Components. |

|

| By Train Type Diesel Multiple Units, Metros & High-Speed Trains and Electric Multiple Units. |

|

| Companies covered | ABB; Alstom S.A; Aselsan A.S; Bombardier Inc; CAF, Construcciones Auxiliar de Ferrocarriles, S.A.; China Railway Signal & Communication Corporation Limited; DEUTA-WERKE GmbH; EKE-Electronics Ltd; Hitachi Ltd; Knorr-Bremse AG; Mitsubishi Electric Corporation; Siemens AG; Strukton Rail AB; Thales Group; Toshiba Corporation and Others. |

Segments Covered in Global Train Control & Management Systems market

- The global Train Control & Management Systems market is divided into different segments on the basis of Solution, Component, Train Type, and region. The Solution market segment on the basis of Communication-Based Train Control, Positive Train Control, Integrated Train Control. On the basis of Component, the Train Control & Management Systems market segment comprises a Vehicle Control Unit, Human Machine Interface, Mobile Communication Gateway, Other Components. The global Train Control & Management Systems market segment by the Train Type involves Diesel Multiple Units, Metros & High-Speed Trains, Electric Multiple Units and many other sectors.

- The vehicle control unit is the most expensive component of TCMS. Thus, the vehicle control unit is estimated to be the largest segment in the TCMS market, by component. The growth of this segment can be attributed to the high installation rate of TCMS in developed regions and the increasing penetration in developing regions.

- Integrated train control system refers to central traffic control room systems that manage, control and supervise train movement for mainline and mass transit over a wide geographical area. It enables passenger and freight railroads to boost operational efficiency, safety, cybersecurity, and cost-effectiveness. The system allows traffic controllers to follow train movements in real-time, which is essential for smooth traffic and to ensure safety.

Covid-19 Impact on the Global Train Control & Management Systems market

- The tier-2 and tier-3 suppliers of the railway components, which operate in the railway sector supply chain, experienced a sever disruption in the operation due to COVID-19 pandemic. In addition, the COVID-19 outbreak is resulting in economic uncertainty and reduced consumer demand for nonessential vehicles, thus hindering the sale of new locomotives.

- Communication-Based Train Control, one of the segments analyzed in the report, is projected to grow at a 5.85% CAGR to reach US$1.5 Billion by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Positive Train Control segment is readjusted to a revised 6.1% CAGR for the next 7-year period. Communication-Based Train Control, one of the segments analyzed in the report, is projected to grow at a 5.9% CAGR to reach US$1.6 Billion by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Positive Train Control segment is readjusted to a revised 6.1% CAGR for the next 7-year period.

Recent Developments in Global Train Control & Management Systems market

- The emerging economies such as India and China are focused on the development of their railway infrastructure by allocating a higher budget. Similarly, various countries across the globe are continuously increasing their rail budget to deploy latest technologies and improve their infrastructure.

- In 2015, Hitachi Ltd. acquired AnsaldoBreda S.p.A. (Italy). This strategic acquisition enabled Hitachi to strengthen its position in the signaling and traffic management system markets.

- In January 2016, Alstom SA signed a supply agreement with India’s Kochi Metro Rail (KMRL) to supply 25 Made in India coaches. Alstom is supplying an initial fleet of 25 three-car metropolis train sets to KMRL under an USD 90 million contract awarded in October 2014, which also includes options for up to 25 additional train sets

- In 2017, Thales Group received a contract from Gülermark-Kolin- a joint venture formed for Bakentray project, to modernize the high-speed line between Ankara and Istanbul with advanced systems such as ETCS, electronic interlocking systems, and centralized traffic control system.

- In July 2017, Alstom SA announced to develop and design operational traffic management tool with SNCF Réseau- France based Railway Company for connecting railway network of countries such Lyon, Paris, and Marseille

Key Market Players in Global Train Control & Management Systems market

- The major players in the Global Train Control & Management Systems market are ABB; Alstom S.A; Aselsan A.S; Bombardier Inc; CAF, Construcciones Auxiliar de Ferrocarriles, S.A.; China Railway Signal & Communication Corporation Limited; DEUTA-WERKE GmbH; EKE-Electronics Ltd; Hitachi Ltd; Knorr-Bremse AG; Mitsubishi Electric Corporation; Siemens AG; Strukton Rail AB; Thales Group; Toshiba Corporation and Others.

- Toshiba Corporation announced that it had successfully completed the six-year long Washington Metropolitan Area Transit Authority Project which included a significant order for railway systems and equipment along with communication and monitoring systems.

- Siemens AG, key players in the train control and management systems market received an order for its communication based train control system from the Paris metro operator in France, Régie autonome des transports parisiens (RATP). This opportunity signifies the future prospects of the train control and management systems market.

Objectives of the Global Train Control & Management Systems market Study

- To provide detailed information regarding drivers, restraints, opportunities and challenges are influencing the growth in the Global Train Control & Management Systems market.

- To analyze the competitive intelligence of players based on company profiles and their key growth strategies.

- To strategically analyze micro markets with respect to the individual growth trends, their prospects, and their contribution to the total Global Train Control & Management Systems market.

- To analyze competitive developments such as expansions, and product launches, along with research & development (R&D) activities undertaken in the Global Train Control & Management Systems market.

- A unique model is created customized for each study also offers suggestions that help enterprises to identify and mitigate risks.

Note

- Global Industry Reports will also support you post-purchase for a period of 6 months to answer any of your queries related to the following market and to provide you any more data if you need, for your analysis.

- Also, you can buy some selected Chapters from the report.