Report Overview

- Understand the latest market trends and future growth opportunities for the Advanced Driver Assistance System (ADAS) industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Advanced Driver Assistance System (ADAS) Market” by various segments at a global and regional level for the 2010-2028 period, with 2010-2021 as historical data, 2022 as a base year, 2023 as an estimated year and 2023-2028 as forecast period.

Description:

- Amid the COVID-19 crisis, the global market for Advanced Driver Assistance System (ADAS) estimated at US$23.3 Billion in the year 2020, is projected to reach a revised size of US$77.8 Billion by 2027, growing at a CAGR of 18.8% over the analysis period 2021-2027.

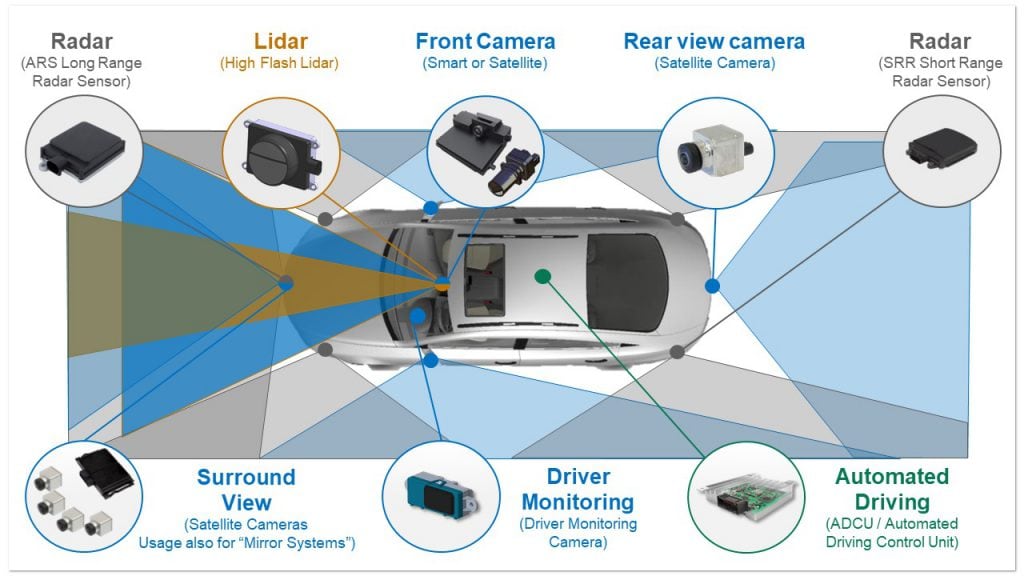

- Processor, one of the segments analyzed in the report, is projected to record a 20.6% CAGR and reach US$26.2 Billion by the end of the analysis period. Growth in the Sensors segment is readjusted to a revised 18% CAGR for the next 7-year period.

- The U.S. Market is Estimated at $6.9 Billion, While China is Forecast to Grow at 18% CAGR. China, the world`s second largest economy, is forecast to reach a projected market size of US$13.3 Billion by the year 2027 trailing a CAGR of 18% over the analysis period 2021 to 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 16.9% and 16.1% respectively over the 2021-2027 period. Within Europe, Germany is forecast to grow at approximately 13.7% CAGR.

- In the global Software segment, USA, Canada, Japan, China and Europe will drive the 19.2% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$2.7 Billion in the year 2020 will reach a projected size of US$9.2 Billion by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$9.3 Billion by the year 2027.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2028, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

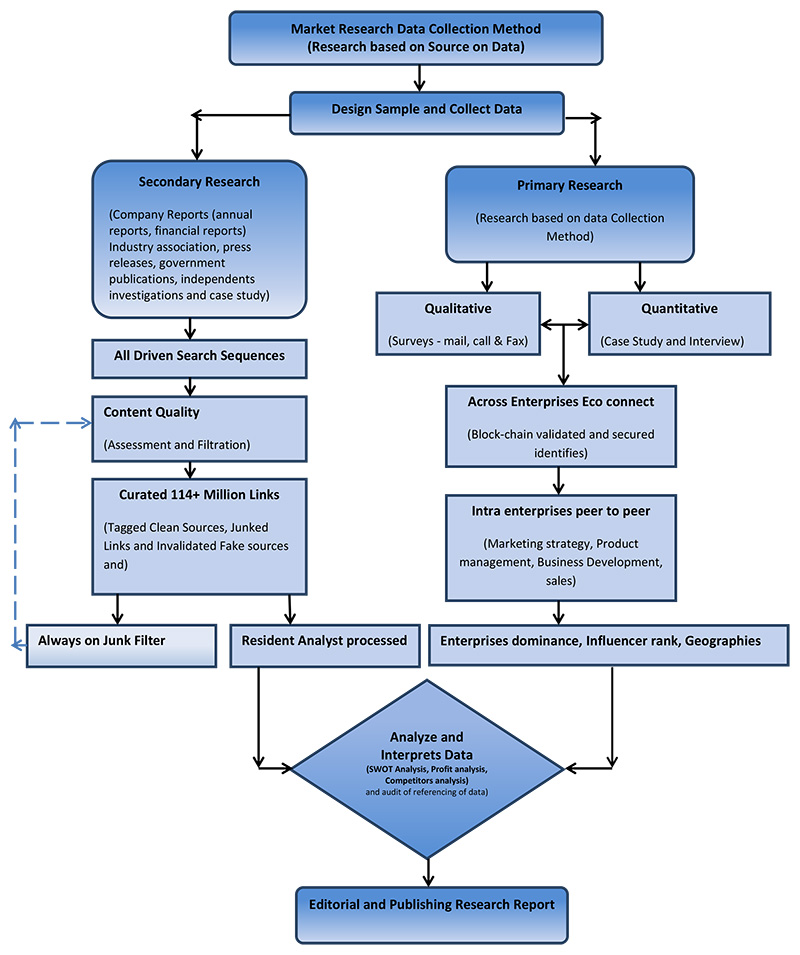

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2022 | USD 46.7 Billion |

| Revenue forecast in 2027 | USD 77.8 Billion |

| Growth Rate | CAGR of 18.8% from 2022 to 2028 |

| Base year for estimation | 2022 |

| Historical data | 2015 – 2021 |

| Forecast period | 2022 – 2028 |

| Quantitative units | Revenue in USD million and CAGR from 2022 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives

COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews. Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Product, Type, Operation, Technology, Application, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | Aisin Seiki Co. Ltd.; Aptiv PLC; Autoliv Inc.; AVL GmbH; Continental AG; Delphi Automotive LLP; DENSO Corporation; Gentex Corporation; Harman International; Hella GmbH & Co. KGaA; Hitachi Ltd.; Hyundai Mobis Co. Ltd.; Infineon Technologies AG; Jayson Electronics; Lear Corporation; Magna International Inc.; Mobileye N.V. (Intel Corporation); NVIDIA Corporation; NXP Semiconductors N.V.; Osram Licht AG; Panasonic Corporation; Renesas Electronics Corporation; Robert Bosch; Siemens AG; STMicroelectronics N.V.; Tesla Inc.; Texas Instruments Inc.; TRW Automotive (ZF Group); Valeo SA; Veoneer Inc.; Volkswagen Group; ZF Friedrichshafen AG and others |

| Customization scope | Free report customization (equivalent up to 20 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

ADAS Report Segmented by:

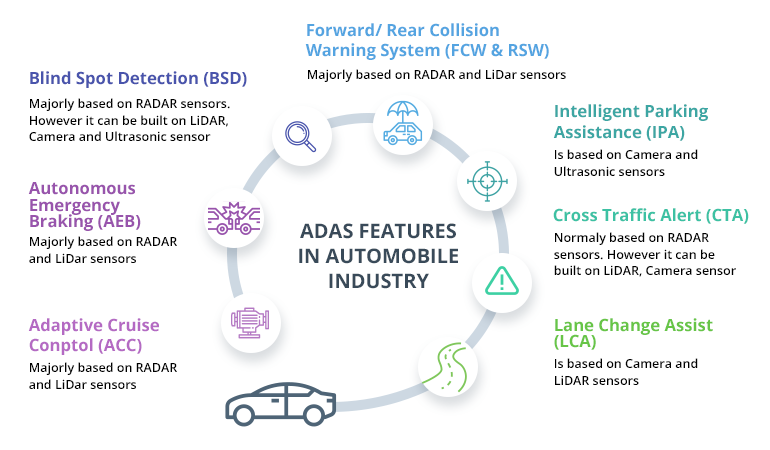

| Based On System | Based On Component | By vehicle type | By Region |

| Adaptive Cruise Control (ACC) | Camera Unit | Passenger Car | North America |

| Adaptive Front Light (AFL) | LiDAR | Light Commercial Vehicle | Europe |

| Automatic Emergency Braking (AEB) | Radar Sensor | Truck | South America |

| Blind Spot Detection (BSD) | Ultrasonic Sensor | Bus | MEA |

| Cross Traffic Alert (CTA) | Infrared Sensor | Battery Electric Vehicles (BEV) | Asia Pacific |

| Driver Monitoring System (DMS) | Hybrid Electric Vehicles (HEV) | Rest Of World | |

| Forward Collision Warning (FCW) | Plug-in Hybrid Electric Vehicle (PHEV) | ||

| Intelligent Park Assist (IPA) | Fuel Cell Electric Vehicle (FCEV) | ||

| Lane Departure Warning (LDW) | |||

| Night Vision System (NVS) | |||

| Pedestrian Detection System (PDS) | |||

| Road Sign Recognition (RSR) | |||

| Tire Pressure Monitoring System (TPMS) | |||

| Traffic Jam Assist (TJA) | |||

| Head-up display |

Companies Covered in Report:

| Aisin Seiki Co. Ltd. | Mobileye N.V. (Intel Corporation) |

| Aptiv PLC | NVIDIA Corporation |

| Autoliv Inc. | NXP Semiconductors N.V. |

| AVL GmbH | Osram Licht AG |

| Continental AG | Panasonic Corporation |

| Delphi Automotive LLP | Renesas Electronics Corporation |

| DENSO Corporation | Robert Bosch |

| Gentex Corporation | Siemens AG |

| Harman International | STMicroelectronics N.V. |

| Hella GmbH & Co. KGaA | Tesla Inc. |

| Hitachi Ltd. | Texas Instruments Inc. |

| Hyundai Mobis Co. Ltd. | TRW Automotive (ZF Group) |

| Infineon Technologies AG | Valeo SA |

| Jayson Electronics | Veoneer Inc. |

| Lear Corporation | Volkswagen Group |

| Magna International Inc. | ZF Friedrichshafen AG |

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2022 base year report.

- Free Updated edition of 2023 every quarter without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.

Key questions that are answered in this report

- What are some of the most promising, high-growth opportunities for the automotive ADAS market by product (AEBS, FCW, ACC, BSD, LDW, PAS, PDS, TSR, NV, DDD), by technology (radar, camera, sensor fusion, LIDAR, infrared, ultrasonic), vehicle type (large car, SUV and crossover, mid-size car, and others), and end user (OEM and aftermarket) ?

- Which segments will grow at a faster pace and why?

- What are the key factors affecting market dynamics? What are the key challenges and business risks in this automotive ADAS market?

- What are the business risks and competitive threats in this automotive ADAS market?

- What are the emerging trends in this automotive ADAS market and the reasons behind them?

- What are some of the changing demands of customers in the automotive ADAS market?

- What are the new developments in the automotive ADAS market? Which companies are leading these developments?